You bought another money book last month. You read it cover to cover. You felt motivated for about a week.

However, your bank account appears to have remained unchanged for six months.

Here’s the hard truth: Most money books don’t teach you how to build wealth. They teach you how to manage being broke better.

I spent two years reading 42 popular finance books. I tracked which advice actually moved the needle on my net worth. The results shocked me.

Only 7 books provided me with strategies that actually helped build wealth. The other 35 kept me spinning my wheels with budgets, debt snowballs, and attempts to shift my mindset.

Here’s what I learned about the difference between books that make you feel smart and books that make you rich.

Why Most Money Books Keep You Poor

A Yale economist named James Choi had the same question I did. He read the 50 most popular personal finance books on Goodreads and compared their advice to what actually builds wealth.

His findings? Most popular finance books give advice that contradicts economic theory about how wealth actually grows.

The books focus on psychology instead of math. They tell you to save 10% of your income, whether you make $30,000 or $300,000. That makes no sense.

Economic theory suggests that your savings rate should be low in your 20s and high in your 40s. But the books don’t teach this because it’s harder to understand than “save 10% of everything.”

Here’s what the data shows about actual wealth in America:

The top 10% of households own 76% of all wealth in the U.S., while the bottom 50% own just 1%.

Most money books are written for the bottom 50%. They teach financial survival, not wealth creation.

The wealthy don’t budget their way to millions. They build assets that generate income. Big difference.

The 35 Books That Waste Your Time

I split the useless books into four categories. If you’ve read books like these and aren’t wealthy yet, here’s why.

The Budgeting Obsessed

These books spend 200 pages teaching you to track every coffee purchase. They act like cutting expenses is the path to wealth.

Math problem: If you save $5 per day by skipping coffee, you’ll have $1,825 per year. At that rate, it takes 549 years to become a millionaire.

The wealthy don’t pinch pennies. They focus on making more money and buying assets that grow in value.

The Debt Panic Books

These books say you should pay off your lowest balance debts first, not your highest interest debts. Economists call this the “snowball method,” and most think it’s wrong.

The books recommend it because it feels good to pay off a small debt. But feelings don’t build wealth. Math does.

If you have $10,000 in credit card debt at 22% interest and $50,000 in student loans at 4% interest, you should attack the credit cards first. You’ll save thousands in interest payments.

The Mindset Motivational Books

These books are 80% psychology and 20% strategy. They tell you to “think like a millionaire” without explaining how millionaires actually make money.

Positive thinking doesn’t create wealth. Buying assets that produce income does.

The Basic Investment Books

These books tell you to max out your 401(k) and buy index funds. That’s not wrong, but it’s incomplete.

For 2025, you can put $23,500 in your 401(k) if you’re under 50, or $31,000 if you’re over 50. Great start.

But if that’s your only wealth-building strategy, you’ll be comfortable in retirement, not rich.

The 7 Books That Actually Build Wealth

These books taught me specific strategies I could implement immediately. Each one focuses on building assets, not managing expenses.

1. “The Intelligent Investor” by Benjamin Graham

This book is the bible of value investing. Warren Buffett calls it “by far the best book about investing ever written.”

What it teaches in detail: Graham shows you how to find stocks trading for less than they’re worth. He teaches the difference between investing and speculating. Investing means buying pieces of profitable businesses at reasonable prices and holding them for years. Speculating means trying to guess which way stock prices will move next week.

The book introduces the concept of “Mr. Market” – imagine the stock market as a moody business partner who offers to buy or sell his shares every day. Sometimes he’s optimistic and offers high prices. Sometimes he’s pessimistic and offers low prices. Smart investors buy when he’s pessimistic and sell when he’s overly optimistic.

Graham also teaches the “margin of safety” principle. Don’t just buy good companies – buy them when they’re selling for much less than they’re worth. If a company is worth $100 per share, don’t pay $95. Wait until you can buy it for $70 or less.

Why it works: You’re buying $1 worth of assets for 70 cents. When the market figures this out, you profit. Graham’s students, including Warren Buffett, became some of the richest people in history using these methods.

Action step: Learn to read financial statements. Look for companies with strong balance sheets trading below their book value. Start with large, established companies in boring industries.

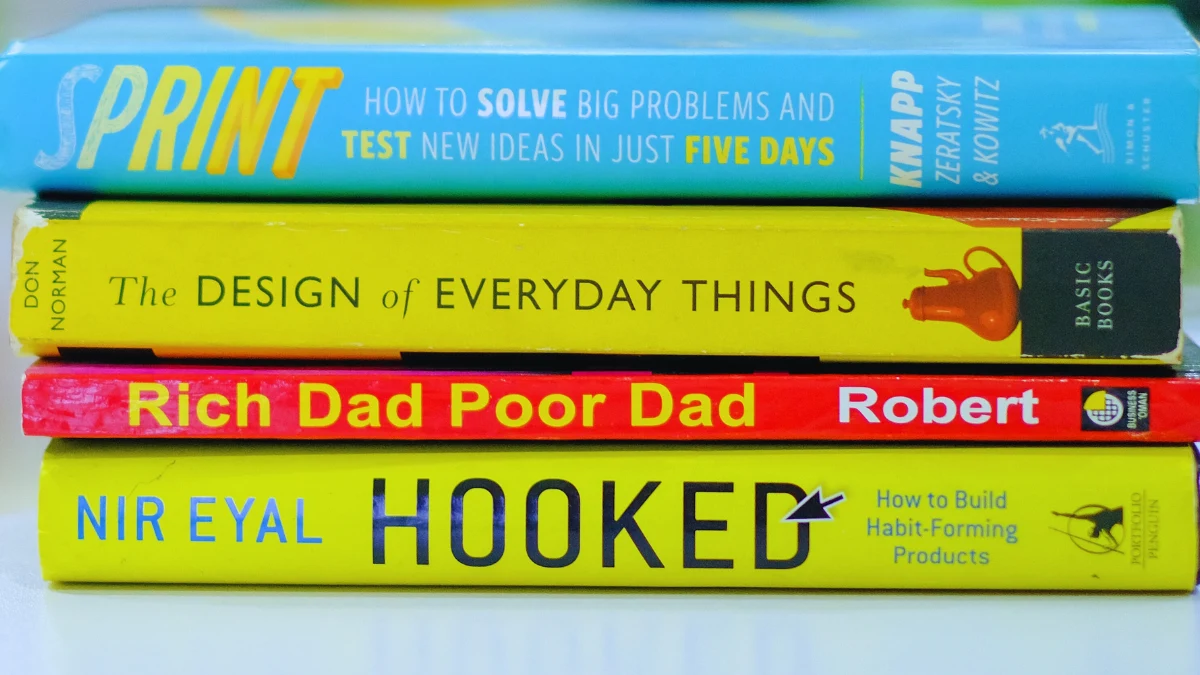

2. “Rich Dad Poor Dad” by Robert Kiyosaki

This book changed how I think about assets and liabilities. Readers say it changed their perspective on wealth building and investing.

What it teaches in detail: Kiyosaki contrasts lessons from his “rich dad” (his friend’s father) and “poor dad” (his real father). Both were educated, but they thought about money differently.

Poor Dad said, “I can’t afford it.” Rich Dad said, “How can I afford it?” Poor Dad focused on job security. Rich Dad focused on financial freedom through assets.

The book’s biggest lesson: Assets put money in your pocket. Liabilities take money out. Your house is not an asset if you live in it – it costs you mortgage payments, taxes, insurance, and repairs every month. But a rental property that generates $300 per month after expenses? That’s an asset.

Kiyosaki explains the “rat race” – working for money instead of making money work for you. Most people get raises and immediately upgrade their lifestyle. They’re stuck working forever. Rich people use raises to buy more assets.

The book also covers the power of corporations and tax advantages. Business owners and investors get tax breaks that employees don’t get.

Why it works: It shifts your mindset from earning money to building income streams. Once you understand the difference between assets and liabilities, you start making different financial decisions.

Action step: List everything you own. Ask yourself: “Does this make me money or cost me money?” Start buying things that generate monthly income.

3. “The Millionaire Next Door” by Thomas Stanley

This book studied actual millionaires to see what they do differently. No theory. Just data from surveying thousands of wealthy Americans.

What it teaches in detail: Most millionaires don’t look like millionaires. They drive used cars, live in modest houses, and shop at discount stores. The flashy, rich people you see on TV are usually broke or headed there.

Real millionaires follow seven key behaviors: They live below their means. Their parents didn’t give them handouts. Their adult children are financially independent.

They’re good at targeting market opportunities (finding undervalued investments). They chose the right occupation (often business owners or professionals). They chose the right spouse (someone who shares their values about money).

The book introduces the wealth formula: Multiply your age by your pre-tax annual income, then divide by 10. That’s what your net worth should be if you’re an average wealth accumulator. If you have twice that amount, you’re a “prodigious accumulator of wealth.”

Stanley shows that high-income people often have low net worth because they spend everything they earn. Meanwhile, people with moderate incomes but high savings rates build serious wealth over time.

Why it works: The research destroys myths about wealth. You don’t need to earn $500,000 per year to become a millionaire. You need to spend less than you earn and invest the difference consistently.

Action step: Calculate your wealth ratio. If you’re behind, identify where your money goes each month. Cut spending on things that don’t matter to you and invest the difference.

4. “The Simple Path to Wealth” by JL Collins

This book cuts through investment confusion and gives you a simple plan that works.

What it teaches in detail: Collins argues that investing is simple, but the financial industry makes it complicated to justify high fees. You don’t need dozens of mutual funds, hedge funds, or individual stocks.

His strategy: Buy one low-cost index fund that owns the entire U.S. stock market. Add money every month regardless of what the market is doing. Hold for decades. That’s it.

The book explains why this works: The stock market has averaged about 10% annual returns over the past 90+ years. Some years it goes up 30%. Some years it drops 20%. But over long periods, it trends upward because businesses become more valuable over time.

Collins shows the power of compound interest with real numbers. If you invest $5,500 per year (the old IRA limit) starting at age 25 and earn 8% annually, you’ll have over $1.4 million by age 65. Wait until 35 to start? You’ll have less than $700,000.

The book also covers when to sell (rarely), how to handle market crashes (keep buying), and why stock picking is usually a waste of time.

Why it works: Simple strategies are easier to stick with. You can’t make emotional decisions if you follow the same plan regardless of market conditions.

Action step: Open a Vanguard, Fidelity, or Schwab account. Buy a total stock market index fund. Set up automatic monthly investments. Don’t check the balance for a year.

5. “The Richest Man in Babylon” by George Clason

This 1920s book uses parables set in ancient Babylon to teach timeless wealth principles.

What it teaches in detail: The book follows Arkad, the richest man in Babylon, as he teaches others the secrets of wealth. The lessons are simple but powerful.

- The first law of gold: Save at least 10% of everything you earn. Pay yourself first, before paying anyone else. Most people pay everyone else first and save whatever’s left (usually nothing).

- The second law: Put your savings to work, earning more money. Don’t let it sit idle. In ancient times, this meant lending money at interest or investing in merchant ventures. Today, it means stocks, real estate, or businesses.

- The third law: Seek advice from people who are successful with money. Don’t take investment advice from your broke coworker.

The book teaches the difference between needs and wants. You can satisfy your necessary expenses with 90% of your income if you’re disciplined about distinguishing between the two.

It also covers the importance of increasing your earning ability. Learn new skills. Become more valuable. The more you can earn, the more you can save and invest.

Why it works: The principles are so basic they’re hard to argue with. Save money, invest it wisely, and let time work in your favor. These laws worked 4,000 years ago, and they work today.

Action step: Set up automatic transfers to move 10% of every paycheck to a separate investment account before you pay any bills. Treat it like a non-negotiable expense.

6. “I Will Teach You To Be Rich” by Ramit Sethi

This book offers a six-week program with specific actions you can take to automate your finances.

What it teaches in detail: Sethi’s approach focuses on automation and psychology. He knows most people won’t stick to complicated financial plans, so he makes it automatic.

- Week 1: Optimize your credit cards and bank accounts. Get cards with good rewards and no annual fees. Use high-yield savings accounts that actually pay interest.

- Week 2: Beat the banks by negotiating better rates and fees. Call your credit card companies and ask for lower interest rates. Many will say yes just for asking.

- Week 3: Open investment accounts. Set up a 401(k) to get your employer match (free money). Open a Roth IRA for additional tax-advantaged investing.

- Week 4: Create a “conscious spending plan” instead of a restrictive budget. Automatically save and invest a percentage of your income. Spend freely on things you love with what’s left.

- Week 5: Automate your finances. Set up automatic transfers for bills, savings, and investments. The money moves without you thinking about it.

- Week 6: Invest in low-cost index funds using a simple asset allocation based on your age.

Sethi also teaches the psychology of money. He shows why people fail to follow financial advice and how to design systems that work with human nature, not against it.

Why it works: Automation removes emotions from money decisions. You can’t spend money that gets invested before you see it. The system runs itself once you set it up.

Action step: Follow the six-week program exactly as written. Set up all the accounts and automations. Don’t skip steps or try to improve the system until you’ve used it for six months.

7. “The Psychology of Money” by Morgan Housel

Steven Bartlett called this “the best book about money ever written.”

What it teaches in detail: Housel argues that success with money isn’t about intelligence or education. It’s about behavior. The book is full of stories that illustrate how psychology drives financial decisions.

One key lesson: Time and patience matter more than being smart. Ronald Read was a janitor who never earned more than $14,000 per year. When he died, he left $8 million to charity. How? He bought stocks and held them for 50+ years.

Meanwhile, Richard Fuscone was a Harvard MBA who earned millions as an executive. He lost everything in the 2008 financial crisis because he was leveraged and had to sell at the worst possible time.

The book explains why people make irrational financial decisions. We’re wired to avoid short-term pain even when it causes long-term damage. We overreact to recent events and ignore long-term trends.

Housel demonstrates how compound interest works using practical examples. Warren Buffett’s wealth didn’t really take off until he was in his 60s. He’s been investing for 80+ years, but 90% of his wealth was built after age 65.

The book also covers the importance of having “enough.” Many wealthy people destroy their lives trying to get even wealthier. Know when you have enough to be happy.

Why it works: Understanding your own psychology helps you make better decisions. When you know why you want to panic-sell during market crashes, you’re less likely to actually do it.

Action step: Start investing immediately, even if it’s just $50 per month. Time is your biggest advantage, and you can’t get it back once it’s gone.

What Actually Builds Wealth in 2025

Based on current research, here’s what wealthy people actually do. It’s not what most books teach.

They Own Assets That Generate Income

80% of Americans believe real estate is important for long-term wealth building. They’re right.

Real estate investors use strategies like house-hacking, where they live in one unit of a duplex and rent out the other. The rental income covers most or all of their housing costs.

Other income-producing assets include:

- Dividend-paying stocks

- Business ownership

- Peer-to-peer lending

- Royalties from intellectual property

They Have Multiple Income Streams

83% of wealthy people believe having multiple income streams is essential for financial security.

Side hustles can generate $200-$1,000 per month doing things like cleaning houses, reselling furniture, or offering yard work.

The key is starting small and reinvesting the profits into more assets.

They Use Strategic Leverage

Wealthy people use low-interest debt to invest in appreciating assets. They borrow money at 4% to buy assets that return 8%.

Example: You borrow $400,000 at 4% interest to buy a rental property. The property generates enough rent to cover the mortgage payments and produces $200 per month in profit. Plus, the property value increases over time.

This only works if you understand the risks and have backup plans.

They Minimize Taxes Legally

The wealthy focus on minimizing their tax burden within legal boundaries.

They max out retirement accounts, use tax-loss harvesting, and structure their investments to minimize taxable income.

You can contribute up to $23,500 to a 401(k) in 2025 if you’re under 50, or $31,000 if you’re over 50. That reduces your taxable income by the same amount.

How to Choose Books That Actually Help

Stop reading books that make you feel good and start reading books that make you money.

Here’s my test for whether a money book is worth your time:

- Does it give you specific numbers? Good books tell you exactly how much to save, invest, or spend. Bad books speak in generalities.

- Does it focus on making money or saving money? Making more money has unlimited potential. Cutting expenses has a floor.

- Does it teach you to buy assets? Wealth comes from owning things that produce income, not from having cash in savings accounts.

- Can you implement it immediately? If you can’t take action within a week of reading it, the book is probably theory disguised as advice.

- Does it assume you want to be rich? Some books assume you just want to be financially stable. That’s fine, but it’s not the same as building wealth.