A silent tremor is shaking the foundations of our city skylines, and its source is a staggering $1.5 trillion wall of debt.

Commercial real estate loans, born in an era of easy money, are now coming due in a brutal new economic climate where refinancing is a near-impossible task. This isn’t just a balance sheet problem; it’s a slow-motion crisis hollowing out downtown cores and pushing regional banks to the brink.

The so-called “maturity wall” is actually a relentless wave, and its impact is already visible on our streets.

We will now dissect this financial storm, revealing the mechanics behind the defaults, the sectors facing collapse, and the real-world consequences of this historic financial reckoning.

The $1.5 Trillion Challenge: Anatomy of the CRE Maturity Wall

The commercial real estate sector is currently confronting a debt challenge of historic proportions.

A massive volume of loans is set to mature over a condensed period, creating intense pressure on borrowers to refinance in a market environment that is fundamentally less favorable than when these loans were originated.

This phenomenon, widely termed the “maturity wall,” is better understood as a “maturity wave”—a rolling, persistent challenge that will unfold over several years and reshape the industry’s financial landscape.

Defining the “Maturity Wall” vs. the “Maturity Wave”

The term “maturity wall” refers to the growing concentration of commercial loans coming due over a short period. However, this metaphor can be misleading, suggesting a single, static event.

A more accurate description is a “maturity wave,” which captures the dynamic and protracted nature of the crisis. It is not an immovable object to be scaled once, but rather a series of rolling challenges that will test the market’s resilience quarter after quarter.

This distinction is critical for strategic planning, as it frames the problem as a prolonged period of stress requiring sustained adaptability, rather than a singular shock that will quickly pass.

The outcomes will vary significantly by asset class, geography, and the specifics of each loan’s capital structure, demanding a nuanced and proactive approach from all market participants.

Quantifying the Crisis: A Breakdown of Maturing Loan Volumes (2025-2027)

The scale of the maturity wave is staggering. In 2025 alone, an estimated $957 billion in CRE loans are scheduled to mature, a figure that is nearly three times the 20-year historical average of $350 billion per year.

This volume represents approximately 20% of the entire $4.8 trillion in outstanding commercial mortgage debt.

The pressure is not confined to a single year. When combined with loans maturing in 2026, the industry faces well over $1.5 trillion in refinancing activity within a two-year window.

Projections extending through 2027 show the total volume of maturing debt reaching approximately $2.2 trillion. This sustained pressure underscores the long-term nature of the challenge.

The risk is not evenly distributed across the financial system. An analysis of the 2025 maturities reveals a heavy concentration of risk within specific lender types.

Depository institutions (banks and thrifts) hold the largest share, with $452 billion in loans maturing. The next most exposed category is Commercial Mortgage-Backed Securities (CMBS), Collateralized Loan Obligations (CLOs), and other asset-backed securities, which account for $231 billion.

In stark contrast, government-sponsored enterprises (GSEs) such as Fannie Mae and Freddie Mac, which primarily back multifamily and healthcare properties, have a minimal exposure of just $31 billion maturing in 2025.

This distribution pinpoints CMBS and regional banks as the primary fault lines where stress is most likely to translate into systemic risk.

CRE Loan Maturity Volumes by Lender Type (2025)

| Lender Type | Maturing Volume ($ Billions) | % of Outstanding Balance |

| Depositories | $452 | 25% |

| CMBS, CLOs, or other ABS | $231 | 29% |

| Credit Co., Warehouse, Other | $180 | 35% |

| Life Insurance Companies | $64 | 9% |

| GSEs (Fannie Mae, Freddie Mac, etc.) | $31 | 3% |

| Data synthesized from the Mortgage Bankers Association’s 2024 Commercial Real Estate Survey of Loan Maturity Volumes. |

Origins of the Wall: The Legacy of a Low-Rate Environment

The origins of the current maturity wave can be traced directly to the period of historically low interest rates that fueled a surge in transaction activity in 2021 and 2022.

During this time, capital was abundant and inexpensive, encouraging borrowers to take on significant leverage with the expectation that favorable financing conditions would persist.

Many of the loans originated during this period were structured with shorter terms of three, five, or seven years and are now beginning to mature.

The fundamental driver of the crisis lies in the dramatic shift in the macroeconomic environment.

A significant portion of the debt maturing by 2027—nearly 37%—was originated when the federal funds rate was below 0.25%. Today, with the benchmark rate hovering around 4.33%, the cost of debt has multiplied.

This cohort of loans is structurally misaligned with the current economic reality. They were underwritten based on a set of assumptions—perpetual low rates, aggressive rent growth, and continued property value appreciation—that have been completely invalidated.

Consequently, this specific vintage of debt is uniquely vulnerable to refinancing failure, not due to random chance, but because of the specific, now-untenable conditions under which it was created.

The Extension Game: “Extend and Pretend” as a Delay Tactic

In 2023 and 2024, as interest rates began to climb, loan extensions became a prevalent strategy for both borrowers and lenders.

This approach, often dubbed “extend and pretend,” was based on the hope that a short-term reprieve would allow market conditions to improve, making a future refinancing more viable.

Lenders, keen to avoid recognizing losses on their balance sheets, were often willing to grant extensions in exchange for concessions such as a partial paydown of the principal, the funding of new reserves, or a higher interest rate.

However, this strategy has largely served to postpone the inevitable. The hoped-for market recovery has not materialized at the pace required. As one analysis notes, “time bought does not always translate into improved conditions”.

Many of the loans that were extended are now reappearing on the maturity calendar, but in a market that is arguably more challenging than before.

This practice has directly contributed to the swelling of the 2025 maturity volume, which the Mortgage Bankers Association estimates is 3% larger than it would have been without the wave of extensions from 2024.

The extension game has effectively kicked the can down the road, but the road has led to the foot of an even steeper hill.

The Engine of Distress: Understanding CMBS and Surging Delinquencies

While the maturity wall affects all corners of the CRE debt market, the most acute and transparent signs of distress are emerging from the Commercial Mortgage-Backed Securities (CMBS) sector.

As a critical source of capital that is particularly sensitive to market shifts, the performance of CMBS loans serves as a real-time barometer for the health of the entire industry.

The data from 2025 shows a clear and accelerating trend of deterioration, with delinquency rates climbing to levels not seen in years.

A Primer on Commercial Mortgage-Backed Securities (CMBS)

CMBS are financial instruments created by pooling together a diverse group of commercial real estate loans.

These loans, which can be secured by various property types like office buildings, retail centers, and apartment complexes, are bundled into a trust. The trust then issues a series of bonds, which are sold to investors.

These bonds are structured into different classes, or “tranches,” each with a different level of risk and return. Senior tranches have the first claim on the cash flows from the underlying mortgages and are therefore the safest, while junior and unrated tranches absorb losses first but offer higher potential yields.

This structure allows risk to be distributed among a wide range of investors, but it also means that distress in the underlying properties can quickly ripple through the financial system, impacting bondholders from pension funds to insurance companies.

Dissecting the Data: A Deep Dive into 2025 Delinquency Rates

Multiple data providers paint a consistent picture of rising stress within the CMBS market. According to Trepp, a leading CMBS data firm, the overall delinquency rate rose for the sixth consecutive month in August 2025, reaching 7.29%.

This represents a total delinquent loan balance of $44.1 billion out of a total outstanding balance of $604.6 billion. Other rating agencies and data firms confirm this trend.

S&P Global reported a slightly more conservative overall delinquency rate of 6.1% for the same month, corresponding to a delinquent balance of $40.7 billion. Meanwhile, KBRA reported a rate of 7.5% in July 2025.

While the exact figures vary slightly due to different methodologies, the trajectory is unambiguous.

The market has witnessed a steady, month-over-month increase in delinquencies throughout 2025, a clear pattern of accelerating financial strain as more loans reach their maturity dates and fail to secure refinancing.

Beyond Delinquency: The Importance of Special Servicing and Distress Rates

Focusing solely on the delinquency rate provides an incomplete and often lagging indicator of market health. A more comprehensive view requires an analysis of loans in special servicing.

A loan is transferred to a special servicer when default is considered imminent or has already occurred. These are workout specialists tasked with restructuring the loan, negotiating with the borrower, or, if necessary, proceeding with foreclosure to maximize recovery for bondholders.

The number of loans in special servicing often exceeds the number of loans that are technically delinquent.

This is because the transfer to special servicing can happen before a borrower misses a payment, acting as a forward-looking indicator of trouble.

Data from KBRA illustrates this gap vividly: in July 2025, while the delinquency rate was 7.5%, the total “distress rate”—which includes both delinquent loans and current-but-specially-serviced loans—stood at 10.6%.

Similarly, S&P Global reported an overall special servicing rate of 9.7% in August, with the rate for the embattled office sector reaching a staggering 15.7%.

This gap between the delinquency rate and the special servicing rate represents a shadow inventory of troubled assets.

It reflects a market where lenders and servicers are proactively identifying severe stress and initiating workout proceedings before loans officially default.

The widening of this gap throughout 2025 signals a strong belief among market insiders that a larger wave of formal defaults is on the horizon, as many of these specially serviced loans will ultimately fail to be restructured and will be added to the delinquency rolls in the coming months.

Maturity vs. Term Defaults: Pinpointing the Real Problem

A critical distinction in the current crisis is the nature of the defaults. A term default occurs when a borrower fails to make payments during the life of the loan, often due to poor property performance or loss of a major tenant.

A maturity default, however, occurs when a property is performing and has been making its payments, but the borrower is simply unable to pay off the balloon balance when the loan comes due because they cannot secure new financing.

The data unequivocally shows that maturity defaults are the primary driver of the current surge in delinquencies.

An analysis of CMBS loan performance reveals that maturity defaults account for 46% of all delinquencies in conduit deals and an overwhelming 71% of delinquencies in large-loan and single-asset single-borrower (SASB) transactions. This is a crucial finding.

It demonstrates that the crisis is not primarily a story of widespread operational failure at the property level. Instead, it is a crisis of capital markets.

Properties that were viable just a few years ago are now failing, not because their income has collapsed, but because the cost of debt has risen so dramatically that refinancing has become mathematically impossible.

The Perfect Storm: Interest Rates, Valuation Shocks, and the Refinancing Impasse

The escalating crisis in commercial real estate is the result of a perfect storm of macroeconomic forces that have converged to create a severe refinancing impasse.

The pillars that supported the market for the past decade—low interest rates, stable property values, and readily available credit—have all crumbled simultaneously.

This has left a generation of loans, underwritten in a vastly different era, stranded and unable to qualify for new financing under the current, more stringent market conditions.

The New Rate Reality: The Impact of “Higher for Longer”

The most significant catalyst for the current distress is the sharp and sustained increase in interest rates. Following a series of aggressive hikes by the Federal Reserve that began in 2022, borrowing costs remain historically elevated.

The impact on refinancing is stark. According to S&P Global, the average interest rate on maturing CRE mortgages is approximately 4.3%.

In contrast, the average rate on new loans originated in 2024 was roughly 6.2%—a nearly 200-basis-point increase that can dramatically alter the financial viability of a property.

This new rate reality has become the single greatest concern for CRE industry leaders.

A 2025 survey by Deloitte revealed that elevated interest rates have surged from being the seventh-ranked concern in 2024 to the number one spot, reflecting the pervasive anxiety across the sector.

The tangible effect of this pressure is evident in the dramatic rise of loan modifications. As borrowers find themselves unable to refinance, they are increasingly turning to their current lenders to restructure existing debt.

In the second quarter of 2025, U.S. banks modified $27.7 billion in CRE loans, a staggering 66% year-over-year increase.

This surge is direct evidence of the widespread strain, as lenders work to prevent a wave of outright defaults by altering terms for loans that no longer make financial sense in the current rate environment.

The Valuation Squeeze: The Double-Edged Sword of Falling Values

Compounding the problem of higher borrowing costs is a significant decline in property valuations.

There is an inverse relationship between interest rates and property values. As interest rates rise, investors demand higher returns on their capital, which is reflected in higher capitalization (cap) rates.

When cap rates expand, the calculated value of a property, which is based on its net operating income, falls.

This has created a critical valuation squeeze for borrowers seeking to refinance. Lenders typically require a new appraisal as part of the underwriting process for a new loan.

In the current market, this new appraisal often reveals that the property is now worth less than the outstanding loan balance—a situation known as “negative equity”.

When a property is underwater, traditional refinancing becomes nearly impossible, as no new lender will be willing to issue a loan that exceeds the value of the collateral.

The severity of this valuation shock is underscored by data from the National Council of Real Estate Investment Fiduciaries (NCREIF), which shows that national CRE prices have experienced a peak-to-trough decline of 18.7%, a downturn second in severity only to the one experienced during the Great Financial Crisis.

The DSCR Litmus Test: When Income No Longer Covers Debt

A cornerstone of commercial loan underwriting is the Debt Service Coverage Ratio (DSCR), which measures a property’s annual net operating income (NOI) as a multiple of its annual mortgage payments.

Lenders typically require a DSCR of at least 1.25x, meaning the property’s income must be at least 25% greater than its debt service costs.

Higher interest rates directly attack a property’s ability to meet this test. Even if a property’s income remains stable, a new loan at a much higher interest rate will result in significantly larger monthly payments.

This increase in the denominator of the DSCR calculation can cause the ratio to fall below the lender’s required threshold, leading to the denial of the refinancing application.

This dynamic means that many properties that were considered financially healthy and easily financeable just a few years ago are now unable to qualify for new debt, despite no change in their operational performance.

The Chilling Effect: A Transaction and Liquidity Freeze

The combined impact of high rates, falling values, and stringent DSCR requirements has had a chilling effect on the entire market, leading to a freeze in both transactions and overall liquidity.

A wide “bid-ask spread” has emerged, with potential sellers clinging to pre-downturn valuation expectations while potential buyers are demanding significant discounts to account for the higher cost of capital and increased risk. This has caused transaction volume to slow dramatically.

This lack of liquidity creates a trap for property owners facing a maturing loan. In a healthy market, an owner who cannot refinance has the option to sell the property to pay off the debt.

In the current environment, however, finding a buyer at a price that is sufficient to cover the existing loan is exceedingly difficult. This leaves many borrowers with no viable exit, pushing them closer to default.

The market has shifted from a “growth at all costs” model fueled by cheap debt to a “fundamentals first” model.

This transition disproportionately punishes over-leveraged assets and those that relied on financial engineering, while rewarding properties with strong, stable cash flows and high-quality tenants that can withstand the rigors of the new underwriting environment.

A Market Divided: Sector-Specific Crises and Opportunities

The pressures of the maturity wall are not being felt uniformly across the commercial real estate landscape. Instead, the crisis has exposed and amplified pre-existing structural trends, creating a sharply bifurcated market.

While some sectors, most notably office properties, are facing an existential crisis, others are demonstrating resilience or are undergoing a more modest cyclical correction.

A granular, sector-by-sector analysis reveals a tale of divergent fortunes, where property type has become a primary determinant of survival.

The Epicenter: The Office Sector’s Structural Collapse

The office sector is, without question, the epicenter of the CRE crisis. The widespread adoption of remote and hybrid work models has triggered a structural, not merely cyclical, decline in demand for traditional office space.

This has resulted in a catastrophic deterioration of market fundamentals and credit metrics.

Data from multiple sources confirms the severity of the situation. By August 2025, CMBS delinquency rates for office properties had surged to unprecedented, all-time highs, with Trepp reporting a rate of 11.66%, S&P Global reporting 10.2%, and KBRA reporting 11.8%.

These figures are a direct result of an inability to refinance in the face of collapsing fundamentals. National office vacancy rates have remained stubbornly high, hovering near 19-20%.

This has crushed property cash flows and valuations, leading to a staggering non-payoff rate of 40% for maturing office CMBS loans—meaning two out of every five loans are failing to be repaid at maturity.

Within the sector, a flight to quality has created a massive performance gap. Tenants are abandoning older, outdated Class B and C buildings in favor of modern, amenity-rich Class A properties that can help entice employees back to the office.

This trend is accelerating the obsolescence of a significant portion of the nation’s office stock, leaving owners of lower-quality buildings with few viable options as their assets become functionally unfinanceable and un-leasable.

The Canary in the Coal Mine: Emerging Stress in Multifamily

For years, the multifamily sector was considered the most stable and desirable asset class in commercial real estate, buoyed by strong demographic tailwinds and the simple thesis that everyone needs a place to live.

However, the data from 2025 reveals that this safe-haven status is now under threat, with the sector showing clear and growing signs of stress.

The CMBS delinquency rate for multifamily properties has experienced a dramatic surge. According to Trepp, the rate jumped to a nine-year high of 6.86% in August 2025.

This represents a shocking increase from just 1.84% one year prior, highlighting the rapid pace of deterioration.

This development is particularly concerning because it challenges long-held investment assumptions and signals that even sectors with strong underlying demand are not immune to the consequences of the current financial environment.

The root of the problem lies in the combination of aggressive underwriting during the boom years and a recent surge in new supply. The low-rate era fueled a massive construction boom, particularly in high-growth Sun Belt markets.

Many of these projects, financed with short-term debt, were underwritten with the assumption of perpetual, high-single-digit rent growth.

Now, a flood of new apartment units is hitting the market simultaneously, causing rent growth to stall and, in some submarkets, even decline.

This has created a pincer movement for property owners: revenues are flattening or falling just as their floating-rate debt costs are soaring, leading directly to the spike in delinquencies.

The Resilient and the Restructured: Retail and Industrial

The retail and industrial sectors present a more nuanced picture of resilience and normalization. The retail sector, once left for dead in the face of e-commerce, has stabilized and is now exhibiting a clear bifurcation.

Well-located, grocery-anchored neighborhood centers and open-air shopping centers that cater to essential needs and services are performing strongly.

In contrast, older, enclosed Class B and C malls continue to struggle with high vacancy and declining foot traffic. This split is reflected in a moderate overall CMBS delinquency rate that has hovered in the range of 5.7% to 6.4%.

Industrial properties remain the strongest-performing asset class, benefiting from the long-term tailwinds of e-commerce and the need for modern logistics facilities.

CMBS delinquency rates in the industrial sector are exceptionally low, typically registering around 0.5% to 0.6%. However, the sector is not entirely immune to broader economic trends.

The frenetic pace of rent growth and development seen during the pandemic has started to cool as supply chains normalize and tenant demand moderates from its peak.

While the sector remains fundamentally healthy, the period of supercharged growth appears to be over.

Comparative CMBS Delinquency & Special Servicing Rates by Property Type (August 2025)

| Property Type | Delinquency Rate (%) | Special Servicing Rate (%) | Key Data Sources |

| Office | 11.66% | 15.7% | Trepp , S&P Global |

| Multifamily | 6.86% | 7.3% | Trepp , S&P Global |

| Retail | 6.42% | 11.5% | Trepp , S&P Global |

| Industrial | 0.60% | 0.6% | Trepp , S&P Global |

| Lodging | 6.47% | 9.2% | Trepp , S&P Global |

| Data represents a consolidated view of the latest statistics from Trepp and S&P Global as of August 2025. |

From Balance Sheets to Real Streets: The Tangible Community Impact

The escalating crisis within commercial real estate finance is not an abstract problem confined to the ledgers of distant investors and financial institutions. Its consequences are tangible, cascading from distressed balance sheets to the real streets of communities across the United States.

The rise in delinquencies and defaults is setting off a chain reaction that impacts municipal budgets, local businesses, the construction industry, and the stability of the regional banking system that underpins local economies.

The Specter of Foreclosure: Case Studies in Urban Distress

As loans fail to be refinanced, properties are increasingly entering foreclosure, a process that leaves a visible scar on the urban landscape. This trend is particularly pronounced in the office sector of major downtown cores.

Chicago:

The foreclosure of the 23-story office building at 200 West Monroe Street has been described as “emblematic of a broader crisis” impacting the city’s Loop business district.

In another high-profile case, the historic 175 W. Jackson Blvd. building, which Brookfield Properties purchased for nearly $306 million in 2018, is now facing a sale for a small fraction of its outstanding $250 million loan balance after entering foreclosure proceedings.

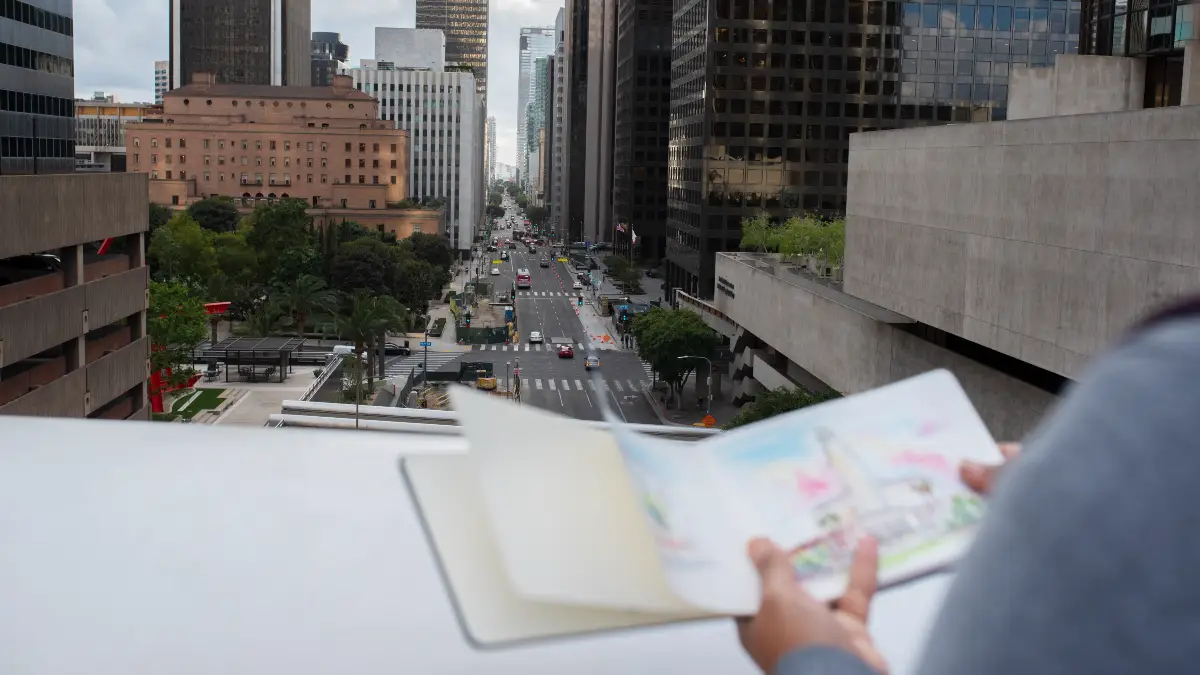

Los Angeles:

A prominent office tower with a distressed loan has become a public “symbol for downtown Los Angeles’ post-pandemic financial struggles,” highlighting the city’s challenges with office vacancy and value erosion.

This pattern of distress is creating a dangerous “doom loop” in many urban centers. The sequence begins with remote work, which drives up office vacancy. High vacancy, combined with high interest rates, causes property values to collapse, leading to a wave of defaults and foreclosures.

As these properties are reassessed at much lower values, the property tax revenue that cities like New York and San Francisco depend on to fund essential public services—such as schools, sanitation, and public safety—is severely diminished.

This forces municipalities to either cut services or raise taxes on remaining businesses and residents, making the city less attractive. This, in turn, can prompt more businesses to leave, further increasing vacancy and completing a self-reinforcing cycle of urban decline.

The impact extends directly to the small businesses that form the fabric of a downtown economy. The dramatic reduction in daily foot traffic from office workers has devastated surrounding restaurants, cafes, and retail shops, many of which are now struggling to survive in hollowed-out business districts.

The Blight of Stalled Progress: The Economic Drag of Halted Construction

The tightening credit environment has also had a chilling effect on new development.

The same financial pressures that prevent existing buildings from being refinanced also make it exceedingly difficult for developers to secure construction loans for new projects.

This has led to a noticeable surge in delayed, on-hold, and abandoned construction sites across the country.

Developers who had planned projects based on the interest rate assumptions of early 2025 now find that their financial projections are no longer viable, forcing them to scale back or shelve projects indefinitely.

This includes not just commercial buildings but also major industrial projects, such as electric vehicle battery plants and semiconductor facilities, which have been paused or canceled due to market uncertainty and the high cost of capital.

The impact of these stalled projects is significant. It results in the direct loss of high-paying construction jobs, disrupts local supply chains for materials and contractors, and ultimately restricts the future supply of needed housing and commercial space, creating a long-term drag on regional economic growth.

The Banking Fault Line: Pressure on Regional Lenders

One of the most significant systemic risks posed by the CRE crisis lies within the U.S. banking sector, particularly among small and regional banks.

Unlike their larger, more diversified counterparts, these smaller institutions have an outsized concentration of CRE loans on their balance sheets. According to Federal Reserve data, CRE debt constitutes an alarming 44% of total loans at regional banks, compared to just 13% at large banks.

This heavy exposure makes them acutely vulnerable to a wave of CRE defaults. As property values fall and borrowers struggle to make payments, these banks could face significant losses, threatening their capital reserves and overall stability.

The case of New York Community Bancorp, which has 57% of its loan portfolio in CRE and reported a $2.7 billion loss in late 2023, serves as a stark warning of the potential for rapid deterioration.

The failure or severe distress of these regional banks would have far-reaching consequences. They are the primary lenders to small and medium-sized businesses in their communities.

A credit crunch originating in their CRE portfolios would inevitably spill over, making it harder for all types of local businesses—from manufacturers to Main Street retailers—to access the capital they need to operate, expand, and create jobs.

Table 3: Case Studies of Distressed CRE Assets and Community Impact

| Property/Project | City | Asset Type | Financial Distress Details | Documented Community Impact |

| 175 W. Jackson Blvd. | Chicago, IL | Office | Foreclosure suit filed; loan balance of ~$250.5M; potential sale at a massive discount. | Contributes to market depression; sets a low valuation precedent for other downtown properties. |

| 200 West Monroe Street | Chicago, IL | Office | Foreclosure filed after failure to repay $75M loan at maturity; loan in special servicing. | Described as “emblematic of a broader crisis”; signals potential for more foreclosures in the Loop. |

| Atmosphere Development | Richmond, BC | Mixed-Use | Project stalled since 2020 after financing was canceled; pre-sale contracts now canceled. | Impacts ~300 pre-sale buyers, construction workers, and consultants; leaves a large excavated site undeveloped. |

| Unnamed Office Tower | Los Angeles, CA | Office | Loan transferred to special servicing; part of >$200M in troubled debt for the owner. | Has become a “symbol for downtown Los Angeles’ post-pandemic financial struggles”. |

| Various Downtowns | NY, SF, Dallas | Office | Sustained drop in property values due to high vacancy and rising defaults. | Saps municipal property tax revenue, hurting funding for public services; harms local small businesses. |

Navigating the Fallout: Strategies, Outlook, and the Path Forward

As the commercial real estate market continues to grapple with the rolling maturity wave, stakeholders are shifting their focus from assessing the problem to deploying strategies for survival and identifying opportunities amid the disruption.

The current environment demands a proactive and creative approach from property owners, lenders, and investors.

While the path forward remains challenging, a combination of diligent risk management, innovative financial and physical restructuring, and a long-term strategic outlook can help navigate the fallout.

Investor and Owner Playbook: Proactive Risk Mitigation

For property owners facing a maturing loan, proactive engagement and rigorous preparation are paramount. The key to navigating this period successfully is to abandon a wait and see approach in favor of early and decisive action.

A critical first step is establishing open and transparent lines of communication with lenders and capital partners well in advance of the loan’s maturity date.

This allows for a collaborative exploration of options before the pressure of an imminent deadline limits the available solutions. Owners should conduct comprehensive scenario planning, modeling both best-case and stress-case refinancing outcomes.

This involves tracking real-time movements in market valuations and cap rates and understanding how even small changes in interest rates could affect the property’s ability to qualify for new debt.

A central strategic decision for many owners is whether to pursue a short-term loan extension or a full, long-term refinancing. An extension can provide valuable breathing room, buying time for market conditions to potentially improve.

However, it often comes at a cost—such as a principal paydown or higher rate—and may only postpone a more significant problem.

A full refinancing, while more difficult to achieve in the current climate, provides a clean break, resetting the clock and offering long-term stability. The right path depends heavily on the specific asset’s performance and the owner’s long-term objectives.

The Rise of Creative Solutions

The retreat of traditional lenders has created a vacuum in the market, which is increasingly being filled by alternative capital sources and innovative restructuring strategies.

Financial Engineering:

Private credit funds, which are more flexible and have a higher risk tolerance than regulated banks, have become a crucial source of liquidity.

These funds are providing capital through various structures, including preferred equity injections and mezzanine debt, which are used to fill the “gap” between the new, smaller senior loan a property can qualify for and the total amount needed to pay off the maturing debt.

Other creative financing tools, such as Commercial Property Assessed Clean Energy (CPACE) financing for energy-efficient upgrades and EB-5 investments that access foreign capital, are also gaining traction as ways to complete a challenging capital stack.

Physical Transformation: The Business Case for Adaptive Reuse:

For properties that are no longer viable in their current form—particularly obsolete office buildings—adaptive reuse is emerging as a powerful solution.

This strategy involves converting a building from one use to another, such as turning an empty office tower into residential apartments or a hotel.

The trend is accelerating rapidly; in 2025, a record-breaking 70,700 apartment units are in the pipeline to be created from office conversions, a dramatic increase from previous years.

Successful conversions in cities like New York, Chicago, and Philadelphia demonstrate the dual benefits of this approach: it removes blighted, non-performing assets from the market while simultaneously helping to address the chronic housing shortages in many urban centers.

This is not merely a temporary fix but a long-term structural shift, reshaping urban landscapes to better align with post-pandemic realities.

Market Outlook for 2026 and Beyond: A Glimmer of Opportunity?

Looking ahead, the consensus among industry experts is that the market will continue to face significant headwinds through 2026 and 2027 as the maturity wave rolls on.

However, there is also a growing recognition that this period of disruption is creating a generational buying opportunity.

Commentary from firms like Moody’s, Deloitte, and Cushman & Wakefield suggests that as the market moves through the acceptance stage of the grieving process, a new equilibrium will be found.

The significant repricing of assets, driven by the collapse in valuations, is creating compelling entry points for well-capitalized investors with a long-term vision.

These investors are now able to acquire high-quality, core real estate assets at valuations that were unimaginable just a few years ago, positioning them to achieve value-add-like returns as the market eventually recovers.

The current market is characterized by a wide divergence of opinion on the path and timing of a recovery. Historically, it is precisely in such moments of uncertainty that the greatest opportunities arise.

The crisis is forcing a necessary and, in the long run, healthy repricing of risk and a renewed focus on property-level fundamentals.

While the fallout will be painful for many, it will also pave the way for a more resilient and rationally priced market, creating a new generation of winners and losers in the commercial real estate industry.