When you see the official 2025 Social Security raise announcement, you might feel… underwhelmed. The projections are hovering around 2.5% (some say 2.6%).

But the real frustration hits when you get your first check in January and realize the raise you see is even smaller than the one you were promised.

You’re not crazy for feeling like you’re falling behind. That 2.5% Social Security raise doesn’t account for the expenses that hit seniors the hardest.

You could say you are.

This article breaks down the math. We’ll show you exactly how your 2.5% raise is eaten by the Medicare Part B increase, leaving you with a net raise of just 1.6%.

Then, we’ll show why that 1.6% is actually a Social Security pay cut when you factor in real inflation.

Most importantly, we’ll give you an actionable plan for 2025.

The “Good News”: Unpacking the 2025 2.5% COLA

First, let’s look at that 2.5% number. This is the Cost-of-Living Adjustment, or COLA. It’s an automatic raise you get based on inflation from the previous year.

The problem is, the government uses an inflation metric called the CPI-W, which tracks the spending of urban workers. It doesn’t track your spending.

What does this 2.5% mean in dollars? Well, the average Social Security benefit in 2025 is projected to be around $1,915. A 2.5% raise on that is about +$47.88 per month.

It’s not life-changing, but it’s something.

But here’s the problem: very few people will actually see that full $48 on their check. That’s because the government takes its cut first.

The First Thief: How the Medicare Part B Increase Snatches Your Raise

The first and biggest thief of your Social Security raise is the Medicare Part B premium.

For most recipients, your Part B premium (which covers doctor visits) is deducted directly from your Social Security payment before you ever see it. And in 2025, that premium is going up.

The 2024 Medicare Trustees Report—this is the official government projection—estimates the standard Part B premium will rise from $174.70 to $185.00 per month.

That’s a $10.30 increase that comes right off the top of your raise.

This is where the math gets personal. The “pay cut” feeling is strongest for those who don’t get the average benefit.

Let’s look at a common scenario: a person receiving $1,144 per month in Social Security.

Here’s the math:

- Their 2.5% Social Security Raise: $1,144 x 0.025 = +$28.60/month

- Their 2025 Medicare Part B Increase: -$10.30/month

- Their Net Raise: $28.60 – $10.30 = +$18.30/month

So, their announced raise was $28.60. Their actual raise is $18.30.

What percentage is that? We take their net raise ($18.30) and divide it by their original benefit ($1,144). The answer is 1.6%.

Your 2.5% “raise” just became a 1.6% “raise.” You’re left with $18. That’s it.

But the story gets worse.

The “Pay Cut”: Why Your 1.6% Net Raise is Still a Loss

You might be thinking, “Okay, 1.6% is terrible, but it’s still a raise. How is that a pay cut?”

Here’s how: The ‘inflation’ the government uses to calculate your raise isn’t the inflation you actually pay.

As we said, the COLA is based on the CPI-W (for workers). This metric puts a lot of weight on things like gasoline and electronics. It under-counts the two things that eat a senior’s budget: healthcare and housing.

Advocacy groups like The Senior Citizens League have pointed this out for years. They track a different metric, the CPI-E (Consumer Price Index for the Elderly), which consistently runs higher.

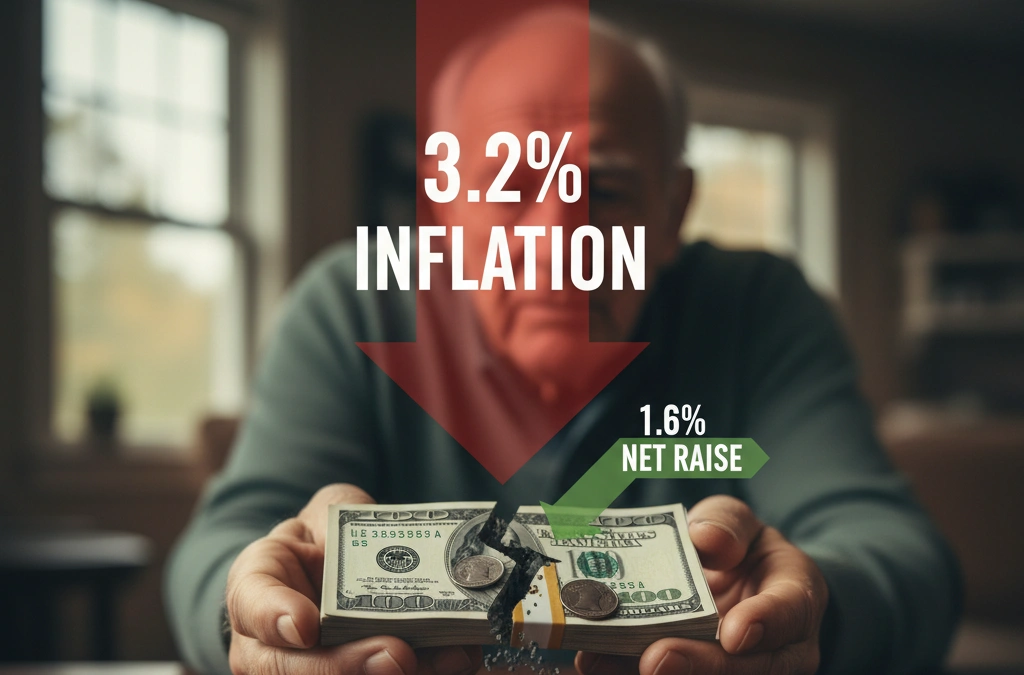

This is the final, brutal math.

- Your Net Raise: 1.6%

- Your Personal Inflation (CPI-E): Let’s say it’s 3.2%

- Your Real-World Result: 1.6% (Raise) – 3.2% (Costs) = -1.6%

That is your 1.6% pay cut.

Your check is $18 bigger, but your life costs $36 more. This is why you feel poorer, even when your check goes up. You are.

An Actionable 2025 Guide: How to Fight Back

Okay, that’s the bad news. I’m not sure, but I don’t see the COLA formula changing soon. You could say we’re on our own.

So, let’s take control. You can’t change the COLA, but you can fight back against high Medicare and other costs. Here is your 2025 action plan.

1. Check Your Eligibility for Medicare Savings Programs (MSPs)

This is the single most important thing you can do. MSPs are state-run programs that help pay your Medicare costs. Millions of seniors are eligible and don’t even know it.

- What it is: Programs like the “Qualified Medicare Beneficiary” (QMB) program can pay your entire $185.00 Part B premium. That’s a $2,220 raise right there. Other programs (SLMB and QI) pay a portion.

- Who is eligible: The income limits are higher than you think. For 2024, an individual could make up to ~$1,715/month and still qualify for help in many states.

- Action: Contact your state’s SHIP (State Health Insurance Assistance Program) office. It’s a free, unbiased service.

2. Appeal Your IRMAA (If Your Income Dropped)

IRMAA is an extra charge high-earners pay for Part B. The “high-earner” limit for 2025 is based on your 2023 tax return.

- Who is this for? Did you retire in 2023 or 2024? Did you get divorced? Did you lose a high-income spouse? If so, you are likely overpaying.

- Action: File Form SSA-44 (“Life-Changing Event”) with the Social Security Administration. This tells them your 2023 income is no longer relevant and asks them to re-calculate your premium based on your current income.

3. Re-Shop Your Part D & Advantage Plans. Every Single Year

I cannot stress this enough. Insurers change their drug coverage (formularies), copays, and provider networks every year. The plan that was great in 2024 could be a disaster in 2025.

- What it is: During the Open Enrollment Period (Oct. 15 – Dec. 7), you have a free pass to switch plans.

- Action: Use the official Medicare.gov Plan Finder tool. Enter your specific drugs and pharmacy. A 20-minute check can (and often does) save people over $500 a year.

4. Use a “Benefits Check-Up” Tool

You may be missing out on local benefits you’ve earned.

- What it is: Free, confidential online tools that scan for thousands of federal, state, and local benefits.

- Action: Go to the National Council on Aging (NCOA) website and use their BenefitsCheckUp tool. It will scan for everything: SNAP (food stamps), utility assistance (HEAP), property tax relief, and more.

It’s Your Money. Claim It.

That 2.5% Social Security raise feels like a lie because, for many, it is. The Medicare Part B increase reduces it to a measly 1.6%, and real senior inflation turns that into a 1.6% pay cut.

It’s frustrating.

But you are not powerless. Don’t just get mad. Get action.

Your one task for today: Find your state’s SHIP office number or go to the NCOA’s Benefits CheckUp website.

It takes 10 minutes, and it could find the exact money that your 2025 COLA failed to deliver.