In today’s fast-paced business world, strategic planning isn’t just important—it’s critical.

Did you know that 90% of companies fail to execute their strategies successfully? To avoid becoming part of that statistic, leveraging the right tools can make all the difference.

Whether you’re a startup navigating your market or an established company aiming to maintain your edge, selecting the best tools for business planning and strategy is key.

These tools can streamline your processes, sharpen your focus, and drive impactful decisions.

Ready to explore the best options? Let’s dive in and discover the tools that can shape your business future.

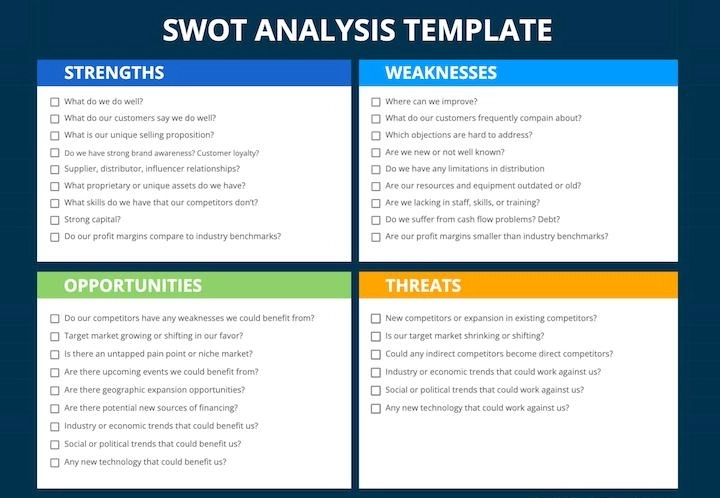

SWOT Analysis in Business Planning and Strategy

Reason to Apply SWOT Analysis

- Holistic View of Business Environment: SWOT analysis offers a comprehensive snapshot of an organization’s current position by identifying internal strengths and weaknesses, as well as external opportunities and threats. This broad view is crucial for informed decision-making.

- Strategic Prioritization: It helps businesses prioritize areas that require immediate attention, such as leveraging strengths to capitalize on opportunities or addressing weaknesses to mitigate threats, thus guiding resource allocation effectively.

- Enhanced Decision-Making: By systematically analyzing each quadrant of the SWOT matrix, businesses can develop strategies that are more likely to succeed, given the current internal and external conditions.

- Adaptability and Proactive Planning: The analysis prepares organizations to respond proactively to potential threats and to explore opportunities that may not have been previously considered.

What Sets SWOT Analysis Apart

- Simplicity and Versatility: One of the key strengths of SWOT analysis is its simplicity. It does not require extensive training or complex software, making it accessible to businesses of all sizes. Additionally, it can be applied to various levels of planning, from high-level corporate strategy to specific projects.

- Collaborative Tool: SWOT analysis encourages cross-functional collaboration, bringing together diverse perspectives from within the organization. This collaboration often leads to a more thorough and realistic understanding of the business’s current state.

- Foundation for Other Strategic Tools: SWOT analysis serves as an excellent foundation for more detailed strategic frameworks. It can be integrated with tools like PESTEL analysis or Porter’s Five Forces to create a more comprehensive strategic plan.

What It Lacks

- Lack of Quantitative Analysis: While SWOT provides a qualitative assessment of the business environment, it often lacks the depth of quantitative analysis. For instance, it might identify “low market share” as a weakness but doesn’t provide specific metrics or financial data to quantify the impact.

- Risk of Oversimplification: The simplicity of SWOT can also be a drawback. Businesses might oversimplify complex issues or overlook critical factors that do not neatly fit into one of the four categories. This can lead to strategic blind spots.

- Subjectivity: The process of identifying strengths, weaknesses, opportunities, and threats can be highly subjective. The results of a SWOT analysis might vary significantly depending on who is conducting the analysis, which can lead to inconsistent or biased outcomes.

- Static Nature: SWOT is typically conducted as a one-time analysis, which might not account for the dynamic nature of business environments. Without regular updates, the insights gained from a SWOT analysis can quickly become outdated.

Balanced Scorecard in Business Planning and Strategy

Reasons to Apply the Balanced Scorecard

- Holistic Performance Measurement: The Balanced Scorecard (BSC) goes beyond traditional financial metrics by incorporating additional perspectives—Customer, Internal Processes, and Learning & Growth. This provides a more comprehensive view of organizational performance.

- Strategic Alignment: The BSC ensures that all business activities are aligned with the organization’s vision and strategy, facilitating a unified approach to achieving long-term goals.

- Improved Communication: By translating strategic goals into measurable objectives across multiple perspectives, the BSC enhances internal communication and ensures that everyone in the organization understands their role in achieving the overall strategy.

- Enhanced Accountability: The assignment of tangible metrics to each perspective fosters a culture of accountability, as employees and teams can clearly see how their performance impacts the organization’s strategic objectives.

What Sets the Balanced Scorecard Apart

- Integration of Multiple Perspectives: Unlike traditional performance measurement systems that focus solely on financial outcomes, the BSC provides a balanced view by including financial, customer, internal process, and learning & growth perspectives. This approach ensures that short-term financial success does not come at the expense of long-term strategic objectives.

- Strategic Maps and Cause-Effect Relationships: The BSC is not just a measurement tool; it also helps organizations develop strategy maps that visually depict the cause-and-effect relationships between different strategic objectives. This feature enables organizations to understand how improvements in one area, such as employee training (Learning & Growth), can lead to better customer satisfaction and, ultimately, improved financial performance.

- Adaptability Across Industries: The BSC is versatile and can be tailored to fit the needs of various sectors, including for-profits, non-profits, and government agencies. Its structure allows organizations of different types and sizes to measure performance in a way that aligns with their specific goals.

What It Lacks

- Complexity in Implementation: While powerful, the BSC can be complex to implement, especially for organizations that are not accustomed to strategic frameworks. It requires careful planning, clear communication, and continuous monitoring, which can be resource-intensive.

- Potential Rigidity: The BSC’s structured nature can sometimes lead to rigidity, making it challenging for organizations to quickly adapt to significant changes in the external environment. This is particularly a concern in rapidly changing industries where flexibility is crucial.

- Overemphasis on Financial Metrics: Despite its balanced approach, some implementations of the BSC may still place too much emphasis on financial outcomes, potentially neglecting other critical areas like innovation or employee development that are harder to quantify but equally important for long-term success.

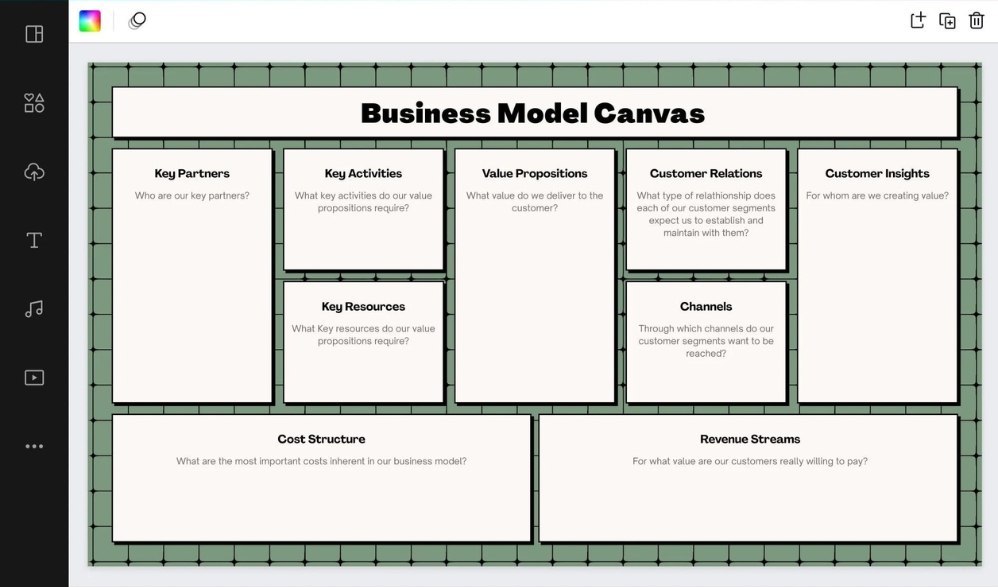

Business Model Canvas in Business Planning and Strategy

Reasons to Apply the Business Model Canvas

- Visualize and Structure Business Models: The Business Model Canvas (BMC) offers a clear, visual representation of all key elements of a business model on a single page. This enables businesses to see the big picture and understand how different components interact.

- Facilitate Innovation and Strategic Thinking: By breaking down a business model into nine distinct building blocks, the BMC fosters creativity and strategic thinking, allowing businesses to explore new opportunities and refine their approach.

- Enhance Collaboration and Communication: The BMC promotes teamwork by providing a common framework for discussing and developing business models. It serves as a shared language among team members, facilitating better communication and collaboration.

- Adaptable and User-Friendly: Suitable for both startups and established businesses, the BMC is versatile and can be adapted to various industries. Its simplicity makes it an accessible tool even for those with little business planning experience.

What Sets the Business Model Canvas Apart

- Holistic Framework: The BMC includes nine key components—Customer Segments, Value Propositions, Channels, Customer Relationships, Revenue Streams, Key Resources, Key Activities, Key Partnerships, and Cost Structure. This comprehensive approach ensures that all critical aspects of a business model are considered.

- Flexibility and Adaptability: Unlike traditional business plans, the BMC is dynamic and can be easily modified as business conditions change. This flexibility allows businesses to pivot and innovate quickly in response to new challenges and opportunities.

- Focus on Value Creation: At its core, the BMC emphasizes the importance of understanding and delivering value to customers. By clearly defining the value proposition and how it will be delivered, businesses can better align their operations with customer needs.

- Efficient Resource Allocation: The BMC helps identify the most critical resources, activities, and partnerships necessary for delivering value. This focus enables businesses to allocate resources more effectively, leading to increased efficiency and cost savings.

What It Lacks

- Limited Depth in Financial Planning: While the BMC includes components like Revenue Streams and Cost Structure, it does not delve deeply into financial projections or detailed budgeting. For businesses requiring comprehensive financial analysis, additional tools or frameworks may be necessary.

- Not a One-Size-Fits-All Solution: The BMC’s broad applicability is also its limitation; it may not fully address the unique needs of certain industries or business models, particularly those with complex operations or regulatory requirements.

- Oversimplification Risk: By condensing a business model onto a single page, there’s a risk of oversimplification. Critical nuances and detailed planning elements might be overlooked, which could lead to gaps in strategy or execution.

Porter’s Five Forces in Business Planning and Strategy

Reasons to Apply Porter’s Five Forces

- Understanding Industry Structure: Porter’s Five Forces provides a detailed analysis of the competitive dynamics within an industry. By evaluating the five forces—competitive rivalry, threat of new entrants, bargaining power of suppliers, bargaining power of buyers, and the threat of substitutes—businesses can better understand the factors shaping their industry and make informed strategic decisions.

- Assessing Profit Potential: The framework helps businesses assess the profitability potential of an industry by examining how each force affects prices, costs, and investments. This understanding is crucial for companies looking to enter new markets or expand within their current industry.

- Strategic Positioning: By identifying the most significant forces affecting competition, businesses can develop strategies to mitigate threats and capitalize on opportunities, improving their competitive position.

- Guiding Long-Term Strategy: The model aids in developing long-term strategies by helping businesses anticipate changes in the industry environment and adjust their strategies accordingly.

What Sets Porter’s Five Forces Apart

- Comprehensive Industry Analysis: Porter’s Five Forces stands out for its ability to provide a holistic view of the competitive landscape within an industry. It doesn’t just focus on direct competitors but also considers the influence of suppliers, customers, potential new entrants, and substitute products.

- Versatility Across Industries: The framework is applicable to a wide range of industries, from traditional sectors like manufacturing to emerging digital markets. It is flexible enough to be used by companies of various sizes and at different stages of their lifecycle.

- Foundation for Competitive Strategy: Porter’s model is closely linked to his concept of generic strategies—cost leadership, differentiation, and focus—which businesses can adopt based on the insights gained from the Five Forces analysis. This connection between industry analysis and strategic positioning makes the model particularly powerful in guiding business strategy.

What It Lacks

- Static Nature: One of the primary criticisms of Porter’s Five Forces is its static nature. The model provides a snapshot of the industry at a particular point in time and may not adequately account for dynamic changes such as technological advancements, regulatory shifts, or evolving consumer preferences.

- Simplistic Analysis: While the model is effective in providing an overview, it may oversimplify complex industry dynamics. Critics argue that it might overlook interdependencies and the nuanced relationships between different forces, leading to an incomplete analysis.

- Limited Scope for Emerging Industries: Porter’s model is rooted in traditional industry structures and may not be fully applicable to rapidly changing or emerging industries, such as those driven by digital transformation or disruptive technologies. It may require adaptation or supplementation with other analytical tools like PESTLE or scenario planning.

- Difficulty in Application: Implementing Porter’s Five Forces can be challenging due to its reliance on subjective judgments and the varying perspectives of analysts. This can lead to inconsistent results, making it difficult to draw actionable insights without further detailed analysis.

PESTEL Analysis in Business Planning and Strategy

Reasons to Apply PESTEL Analysis

- Holistic View of External Environment: PESTEL analysis offers a structured way to examine external macro-environmental factors—Political, Economic, Social, Technological, Environmental, and Legal. This comprehensive view helps businesses anticipate changes that could impact their operations and strategic direction.

- Risk Identification and Mitigation: By identifying potential risks from each PESTEL category, businesses can develop strategies to mitigate these risks before they become significant issues. This proactive approach is crucial for maintaining business stability.

- Opportunity Recognition: PESTEL analysis also helps in identifying new opportunities in the market, such as emerging technological trends or shifts in consumer behavior, enabling businesses to adapt and capitalize on these changes.

- Strategic Alignment: The insights gained from a PESTEL analysis can be used to align business strategies with external conditions, ensuring that the company remains competitive and relevant in its industry.

What Sets PESTEL Analysis Apart

- Broad Scope of Analysis: PESTEL analysis covers a wide range of external factors that can influence a business, making it one of the most comprehensive tools for environmental scanning. Unlike other tools that may focus on specific areas, PESTEL offers a balanced view across multiple dimensions.

- Flexibility and Adaptability: This framework is highly versatile and can be applied to businesses of all sizes and industries. It is particularly useful in industries where external factors rapidly change, such as technology or global trade.

- Foundation for Strategic Planning: PESTEL analysis is often used in conjunction with other strategic tools like SWOT analysis to provide a thorough understanding of both the internal and external environments. This combined approach enhances strategic decision-making and planning.

What It Lacks

- Risk of Oversimplification: One of the main criticisms of PESTEL analysis is the potential for oversimplification. If not conducted thoroughly, the analysis might overlook critical nuances or fail to capture the complexity of certain factors, leading to inaccurate conclusions.

- Static Nature: PESTEL analysis provides a snapshot of the external environment at a given time but does not account for the dynamic nature of these factors. Regular updates are necessary to ensure that the analysis remains relevant as conditions change.

- Lack of Internal Focus: While PESTEL is excellent for understanding external factors, it does not address internal business strengths and weaknesses. Therefore, it is often necessary to complement PESTEL with other tools like SWOT to get a complete picture.

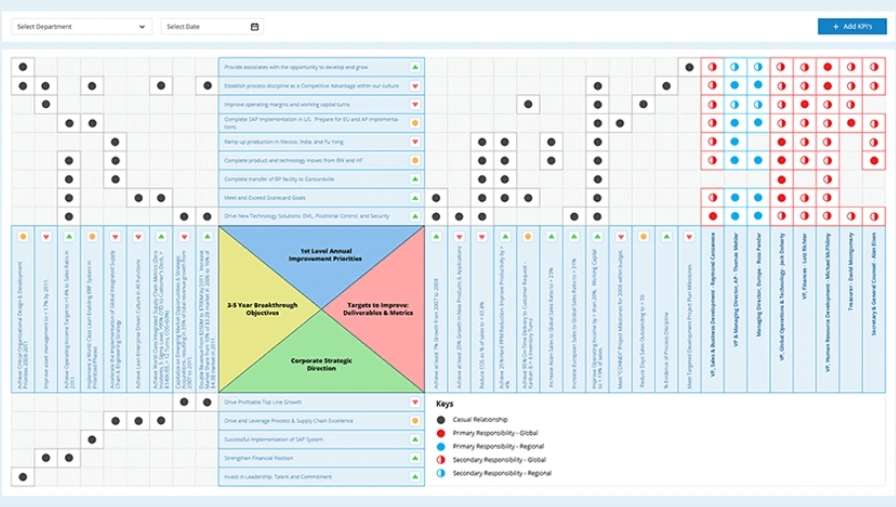

Hoshin Kanri in Business Planning and Strategy

Reasons to Apply Hoshin Kanri

- Alignment Across the Organization: Hoshin Kanri ensures that the entire organization is aligned with common goals. By cascading objectives from top management down to every level, it promotes consistency in efforts and direction across all departments.

- Focus on Strategic Priorities: The method encourages organizations to focus on a few key strategic goals, known as breakthrough objectives, which are intended to drive significant growth or change.

- Enhanced Accountability: Hoshin Kanri fosters a culture of accountability, as it involves clear assignment of responsibilities and regular reviews to track progress towards the strategic objectives.

- Continuous Improvement: The approach emphasizes ongoing reflection and adjustment, integrating the principles of continuous improvement (Kaizen) into the strategic planning process.

What Sets Hoshin Kanri Apart

- Catchball Process for Feedback: One of the unique features of Hoshin Kanri is the “Catchball” process, which involves a back-and-forth exchange of ideas and feedback between different levels of the organization. This ensures that strategic plans are informed by insights from all levels, not just top management.

- Top-Down and Bottom-Up Integration: Unlike traditional strategic planning, Hoshin Kanri combines top-down goal setting with bottom-up input, creating a more collaborative and inclusive approach to strategy development and execution.

- Focus on Long-Term Goals: Hoshin Kanri is particularly strong in setting and achieving long-term strategic goals. It breaks down these goals into actionable annual objectives, ensuring that every step taken is aligned with the broader vision of the company.

What It Lacks

- Challenges with Cultural Shifts: Implementing Hoshin Kanri often requires a significant cultural shift within the organization, especially in fostering open communication and collaboration. Resistance to this change can hinder the effectiveness of the process.

- Complexity in Execution: The process can be complex and time-consuming to implement, particularly in large organizations with multiple layers of management. Ensuring that all departments are aligned and that the process is followed rigorously can be challenging.

- Dependency on Regular Reviews: Hoshin Kanri relies heavily on regular reviews and adjustments. Without consistent follow-through, there is a risk that the strategic objectives may not be met, or the organization could revert to old habits.

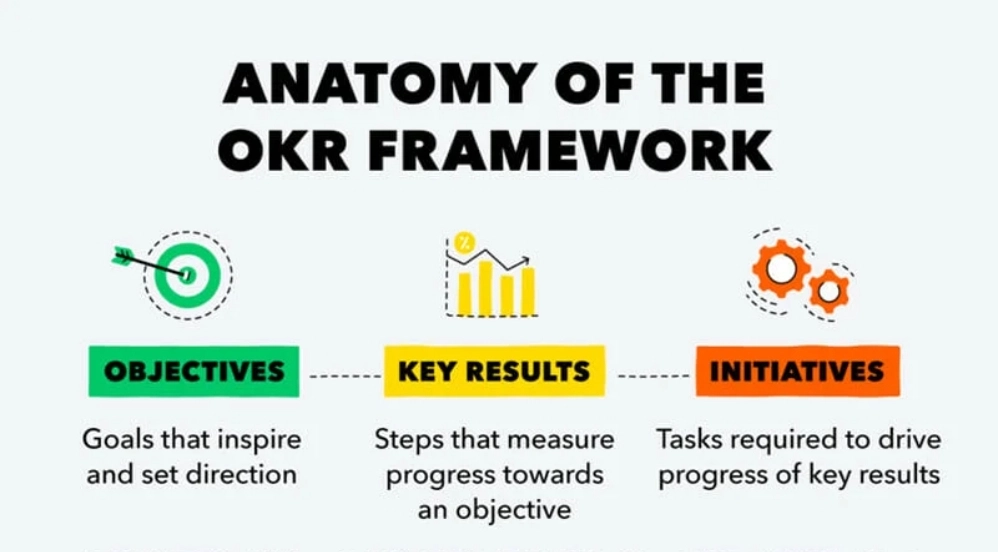

OKRs (Objectives and Key Results) in Business Planning and Strategy

Reasons to Apply OKRs

- Alignment and Focus: OKRs help organizations align their efforts by setting clear objectives that resonate across all levels. By focusing on specific goals, teams can ensure their efforts contribute directly to the company’s strategic priorities, improving overall efficiency.

- Transparency and Engagement: OKRs promote transparency by making objectives and key results visible to everyone in the organization. This visibility fosters accountability and motivates employees by showing them how their work impacts broader organizational goals.

- Agility and Adaptability: The iterative nature of OKRs, often set quarterly, allows organizations to adapt quickly to changing conditions. This flexibility helps businesses stay responsive to market dynamics while maintaining strategic direction.

- Outcome-Oriented Approach: Unlike traditional goal-setting methods that may focus on tasks, OKRs emphasize measurable outcomes. This results-driven approach encourages teams to innovate and find the most effective paths to achieve their objectives.

What Sets OKRs Apart

- Stretch Goals for Innovation: OKRs encourage setting ambitious, stretch goals that push teams beyond their comfort zones. This can lead to breakthrough innovations and significant improvements, even if not all targets are fully met.

- Iterative and Dynamic: The short-term cycles of OKRs, typically set for 90 days, promote continuous reassessment and adjustment. This iterative process ensures that goals remain relevant and aligned with the latest strategic needs of the organization.

- Decentralized Decision-Making: OKRs empower teams by giving them the autonomy to decide how to achieve their objectives. This decentralization fosters creativity and ensures that decision-making is informed by those closest to the work.

- Integration with Company Culture: OKRs are versatile and can be tailored to fit different organizational structures and cultures. This adaptability makes them suitable for a wide range of industries and company sizes.

What It Lacks

- Risk of Misalignment: If not carefully managed, there’s a risk that individual OKRs may become misaligned with broader organizational goals, leading to fragmented efforts that don’t contribute to overall success.

- Implementation Challenges: OKRs require a cultural shift towards transparency, accountability, and frequent feedback, which can be challenging to implement, especially in organizations with established hierarchies and traditional management practices.

- Overemphasis on Measurement: While the focus on measurable outcomes is a strength, it can also be a limitation. There’s a risk of overlooking qualitative aspects of performance or innovation that are harder to measure but equally important.

- Potential for Overextension: The push for ambitious stretch goals might lead to burnout or frustration if not balanced with realistic expectations and adequate resources.

Scenario Planning in Business Planning and Strategy

Reasons to Apply Scenario Planning

- Preparation for Uncertainty: Scenario planning helps organizations prepare for various possible futures by identifying potential events and their impacts. This proactive approach allows businesses to develop contingency plans, making them more resilient to unexpected changes.

- Enhanced Strategic Flexibility: By exploring multiple scenarios, companies can anticipate a range of outcomes and adapt their strategies accordingly. This flexibility is crucial in today’s fast-paced and often unpredictable business environment.

- Improved Decision-Making: Scenario planning enables organizations to make more informed decisions by considering the implications of different future scenarios. This helps in identifying opportunities and mitigating risks before they materialize.

- Long-Term Visioning: This method is particularly effective for long-term strategic planning, as it encourages organizations to look beyond immediate concerns and think critically about how different variables could shape the future.

What Sets Scenario Planning Apart

- Exploration of Multiple Futures: Unlike traditional forecasting, which often focuses on a single expected outcome, scenario planning explores a variety of plausible futures. This comprehensive approach helps organizations prepare for both best-case and worst-case scenarios, enhancing overall strategic robustness.

- Creative and Collaborative Process: Scenario planning is inherently a collaborative exercise, involving input from various stakeholders. This encourages creative thinking and allows for a more holistic understanding of potential risks and opportunities.

- Integration with Other Strategic Tools: Scenario planning can be effectively combined with tools like PESTLE analysis to identify critical uncertainties and driving forces. This integration ensures that scenario planning is grounded in a thorough understanding of the external environment.

What It Lacks

- Complexity and Resource Intensive: The process can be time-consuming and requires significant resources, particularly in gathering data, facilitating workshops, and developing scenarios. This complexity can be a barrier for smaller organizations or those with limited resources.

- Potential for Overemphasis on Unlikely Scenarios: There is a risk that organizations may focus too much on highly improbable scenarios, potentially diverting attention from more likely and pressing issues. Balancing the exploration of various scenarios with practical considerations is essential.

- Challenges in Implementation: While scenario planning is excellent for identifying potential futures, translating these scenarios into actionable strategies can be challenging. The effectiveness of scenario planning depends on the organization’s ability to implement the insights gained in a timely and effective manner.

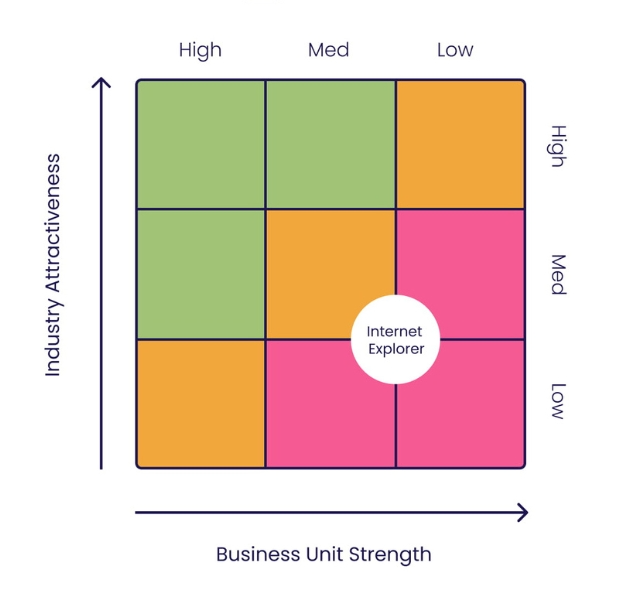

GE McKinsey Matrix in Business Planning and Strategy

Reasons to Apply the GE McKinsey Matrix

- Portfolio Management: The GE McKinsey Matrix is a powerful tool for managing a diversified business portfolio. It helps organizations prioritize investments across different business units or product lines by assessing their industry attractiveness and competitive strength.

- Strategic Decision-Making: By categorizing business units into nine distinct segments based on their performance, the matrix enables companies to make informed decisions about where to invest, hold, or divest. This ensures that resources are allocated effectively to maximize returns.

- Identification of Growth Opportunities: The matrix highlights business units with high potential, allowing companies to focus their efforts on areas that promise the greatest growth. This strategic focus can lead to sustained competitive advantage and long-term success.

What Sets the GE McKinsey Matrix Apart

- Dual-Dimensional Analysis: Unlike simpler tools like the BCG Matrix, the GE McKinsey Matrix uses two dimensions—industry attractiveness and competitive strength—to evaluate business units. This provides a more nuanced and comprehensive view of a company’s portfolio, helping to identify both high-potential and high-risk areas.

- Customization and Flexibility: The matrix can be tailored to fit the specific needs of any organization, regardless of its size or industry. Businesses can define their own criteria for evaluating industry attractiveness and competitive strength, making the tool adaptable to various contexts.

- Strategic Clarity: By visually representing the positioning of business units, the GE McKinsey Matrix offers clear insights into which areas require investment, improvement, or divestment. This clarity is essential for aligning strategic initiatives with overall business goals.

What It Lacks

- Complexity in Implementation: The matrix requires a detailed and often complex analysis of each business unit’s industry attractiveness and competitive strength. This process can be resource-intensive and may require expert consultation to ensure accuracy.

- Subjectivity in Evaluation: The assessment of factors like industry attractiveness and competitive strength can be highly subjective. Different evaluators might assign different weights or ratings, leading to potential inconsistencies in the analysis.

- Limited Consideration of Synergies: The GE McKinsey Matrix does not account for potential synergies between business units. As a result, it may overlook the benefits of integrating or collaborating between units that could enhance overall performance.

- Static Nature: The matrix provides a snapshot based on current data but does not account for dynamic changes in the market or competitive environment. Regular updates are necessary to keep the analysis relevant and actionable.

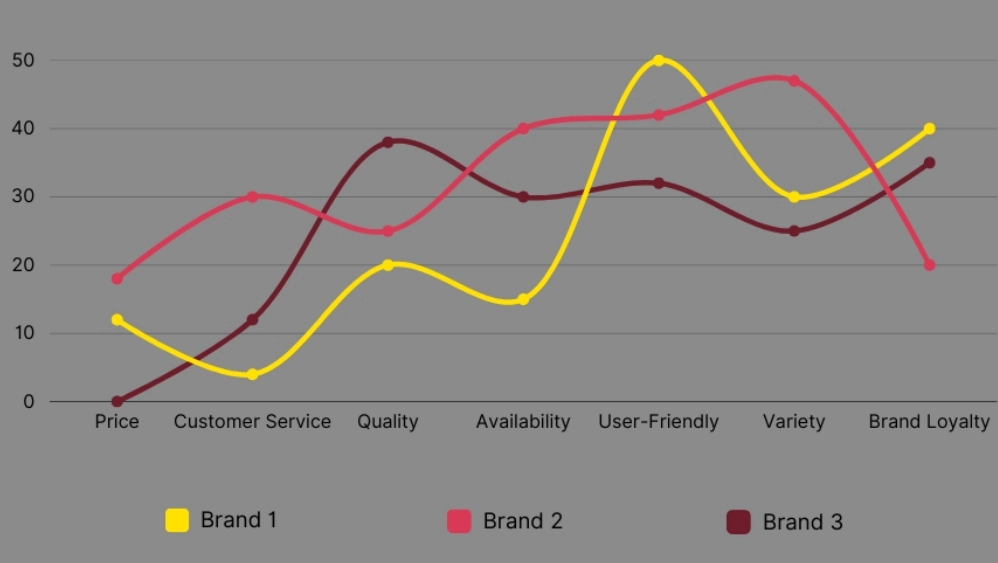

Strategy Canvas in Business Planning and Strategy

Reasons to Apply the Strategy Canvas

- Visual Clarity of Competitive Landscape: The Strategy Canvas offers a clear, visual representation of the current market landscape, helping businesses understand how they and their competitors perform on various key factors. This insight is crucial for identifying areas where a company can stand out.

- Facilitates Strategic Differentiation: By mapping out the factors on which competitors focus, the Strategy Canvas enables businesses to identify opportunities to differentiate their offerings, whether by enhancing certain factors or by creating new ones that competitors haven’t addressed.

- Supports “Blue Ocean” Strategy: The Strategy Canvas is integral to the “Blue Ocean Strategy,” where the goal is to create uncontested market space. By highlighting gaps in the market, it helps companies move away from cutthroat competition and towards innovative, value-driven strategies.

What Sets the Strategy Canvas Apart

- Focus on Value Innovation: The Strategy Canvas goes beyond traditional competitive analysis by emphasizing value innovation—finding new ways to offer superior value to customers. This helps businesses not just compete but create new demand in the market.

- Flexible Application: While typically used for high-level strategic planning, the Strategy Canvas can also be applied to individual products or services. This flexibility allows it to be used across different levels of business strategy, from overarching corporate strategies to specific product-level decisions.

- Integration with the Four Actions Framework: The Strategy Canvas is often used alongside the Four Actions Framework, which encourages companies to think critically about which factors to eliminate, reduce, raise, or create. This combination of tools makes it easier to formulate strategies that stand out in the market.

What It Lacks

- Requires Extensive Market Research: Creating an effective Strategy Canvas demands thorough market research and a deep understanding of customer needs and competitive factors. This can be resource-intensive and time-consuming, especially for companies with limited research capabilities.

- Potential for Oversimplification: The Strategy Canvas simplifies complex competitive dynamics into a single visual, which can sometimes lead to an oversimplified view of the market. Important nuances might be lost, and businesses might overlook critical strategic elements if they rely solely on the canvas.

- Static Nature: Like many strategic tools, the Strategy Canvas provides a snapshot of the competitive landscape at a given time. Without regular updates, the insights it offers can quickly become outdated as market conditions and customer preferences evolve.