I tried for three years to pay off debt. I worked hard and sent in over $10,000 extra. But my balance barely moved.

Why? Because $8,500 of that cash was eaten up by high interest. I wasn’t paying off debt; I was just renting it at a crazy high price. My good effort was wasted because I lacked a sound strategy.

This story is common. Trying hard is not enough. This is a quiet crisis for many. U.S. household debt is now a huge $18.39 trillion, and credit card rates are brutally high, often 20% to 24%.

Experts say these high rates will stay through 2025. Without a clear plan based on math, you will spin your wheels, enriching creditors. This guide is the map you need to stop wasting time and start making real progress.

My 3-Year Detour: The Common Mistakes That Kept Me Stuck

My journey into the debt wilderness was paved with common, seemingly logical mistakes. Each one felt like a sensible choice at the time, but together they formed a perfect system for keeping me stuck.

They weren’t just isolated errors; they were interconnected traps that created a self-reinforcing cycle of failure. Understanding these pitfalls is the first step to avoiding them.

Mistake 1. The Whack-a-Mole Method (An Absence of Strategy)

In the beginning, I had no real plan. My “strategy,” if you could call it that, was reactive and chaotic.

I would pay whichever bill was due next, and if I managed to have any money left over at the end of the month, I’d throw an extra $50 or $100 at the credit card that felt the most “stressful” or had the most aggressive marketing in its monthly statement.

It was financial whack-a-mole: a new problem would pop up, and I’d hit it with a little bit of cash, feeling a momentary sense of accomplishment before the next one appeared.

This approach is doomed to fail because it’s driven by emotion and urgency, not by math and logic. It completely ignores the two most important variables in any debt equation: the interest rate and the balance size.

Without a defined strategy—a conscious choice about which debt to prioritize and why—your extra payments are scattered and their impact is diluted.

You might feel like you’re fighting hard, but you’re fighting an undisciplined war on too many fronts at once. The core principle of effective repayment is focus, and my method had none.

Mistake 2. The Illusion of Progress (The Minimum Payment Trap)

Like many people, I was proud of myself for always paying more than the minimum. Sometimes it was an extra $20, sometimes an extra $50. In my mind, I was getting ahead.

I was doing more than what was required. I thought I was winning. This, I learned, was perhaps the most dangerous illusion of all.

The math behind minimum payments is designed to keep you in debt for as long as possible. Let’s use a brutally clear example. Imagine a credit card with a $7,500 balance at an 18% APR.

If you make a typical minimum payment of $150 per month, it will take you a staggering 94 months (nearly 8 years) to pay it off. During that time, you will have paid $6,466 in interest alone—almost as much as the original debt.

Now, consider what happens if you just double that payment to $300. You slash the repayment timeline to just 32 months and the total interest paid plummets to $1,970. You save over $4,400 and get five years of your life back.

My “little extra” payments were mathematically insignificant. They were just enough to give me a false sense of progress while the interest charges continued to accumulate relentlessly.

Making only the minimum payment, or slightly more, isn’t a repayment plan; it’s a recipe for long-term debt servitude.

Mistake 3. The Financial Firefighting Cycle (The Folly of No Emergency Fund)

My obsession with throwing every spare dollar at my debt led me to neglect a foundational pillar of personal finance: an emergency fund. I reasoned that saving money was a luxury I couldn’t afford while I was being eaten alive by interest. This logic was backward, and it cost me dearly.

The painful lesson came about a year and a half into my journey. I had spent six months aggressively paying down my main Visa card, finally getting the balance under $5,000 for the first time in years.

I felt a surge of momentum. Then, the transmission on my car failed. The repair bill was $2,800. With no savings to draw from, my only option was to put it right back on the very same Visa card.

In a single, soul-crushing afternoon, I erased six months of progress and, more importantly, all of my morale.

This is the financial firefighting cycle. Without a buffer of savings, any unexpected expense—a car repair, a medical bill, an urgent home repair—forces a retreat into more debt.

This creates a demoralizing pattern of one step forward, two steps back. It’s why so many people feel like they can never get ahead. An emergency fund isn’t a distraction from paying off debt; it is the essential shield that protects your debt-repayment plan from being derailed by life.

Mistake 4. Chasing Feel-Good Wins (Ignoring the Interest Rate Beast)

After the car repair debacle, I was discouraged. I needed a win, any win, to feel like I was capable of making progress. I turned my attention to a small retail store credit card with a balance of about $300 and a relatively low 9% interest rate.

I attacked it with everything I had and paid it off in two months. Closing that account felt amazing. I cut up the card and celebrated. One down!

But while I was basking in the glow of that small victory, my $8,000 credit card at 22% APR was quietly doing its destructive work. That month, it added nearly $150 in interest charges to my debt.

My “feel-good win” was a strategic blunder. I had spent my limited resources extinguishing a small campfire while a raging forest fire burned uncontrolled behind me.

This is the psychological pitfall that can make some debt payoff strategies dangerous if not fully understood. The motivation from a “quick win” is a powerful force. But ignoring a high-interest beast to achieve it is financially devastating.

High-interest debt is not a passive problem; it is an active financial emergency that grows more powerful every single day. My intuitive desire for a morale boost led me to make the worst possible mathematical choice.

These four mistakes worked in concert to keep me trapped. The lack of a clear strategy led to inefficient, scattered payments.

This slow progress extended the time I was in debt, which increased the probability that a life event would occur. When it did, my lack of an emergency fund forced me to take on new, high-interest debt.

This demoralizing setback then fueled my desire for an easy psychological win, distracting me from the real mathematical threat. It wasn’t just a list of errors; it was a perfectly engineered debt spiral.

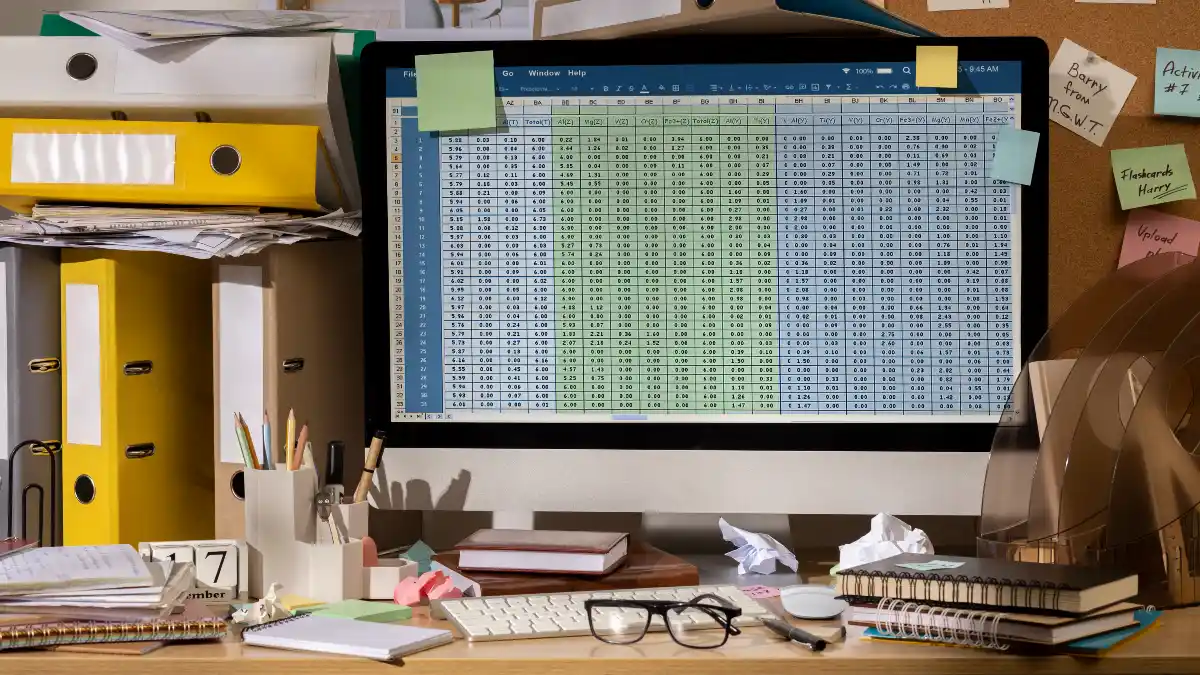

The Painful Epiphany: A Simple Spreadsheet Changed Everything

The 2 a.m. realization was my breaking point. The frustration and futility of my efforts finally outweighed my fear of confronting the full, ugly truth. I decided to stop avoiding and start auditing.

That night, I embarked on a task I had put off for years: I gathered every single bill and statement I could find. Credit cards, my car loan, the remaining balance on my student loans, a small personal loan I’d forgotten about—everything.

I opened a blank spreadsheet and created four simple columns: Creditor, Total Balance, Interest Rate (APR), and Minimum Monthly Payment. For the first time, I wasn’t looking at my debts as a series of individual monthly bills to be paid.

I was looking at them as a single, consolidated enemy with its own strengths and weaknesses. This act of inventorying your debt is the non-negotiable first step toward freedom. You cannot defeat an enemy you do not fully understand.

With the data entered, the battlefield became clear. I could see which debts were merely an inconvenience and which were actively waging war on my net worth. The next step was to calculate the true cost of my current path.

I found a free online debt payoff calculator and plugged in all my numbers. First, I simulated my “Whack-a-Mole” method, allocating my extra payments haphazardly as I had been doing for three years.

The result that flashed on the screen was the climax of my financial horror story. My current path: 12 more years to be debt-free, with an additional $14,000 in future interest payments.

In that moment, I didn’t just see numbers; I saw my three wasted years quantified. I saw the vacations I didn’t take, the investments I didn’t make, the peace of mind I never had—all sacrificed for a strategy that was fundamentally broken.

Then, with a sense of desperate hope, I ran a second simulation. This time, I directed all my extra payments toward the debt with the highest interest rate first—the 22% APR credit card.

The rest I paid the minimums on. The results were stunning. New path: 4 years to be debt-free, with a total of $4,500 in future interest.

Staring at the two scenarios side-by-side was the painful, clarifying epiphany I needed. The difference wasn’t a few months or a few hundred dollars. The difference was eight years of my life and nearly $10,000.

It proved that the most important factor in getting out of debt wasn’t how much extra money I could find, but how intelligently I deployed it. My journey didn’t have to be a decade-long slog.

With the right strategy, I could be free in less than half the time. That spreadsheet didn’t just show me numbers; it showed me the way out.

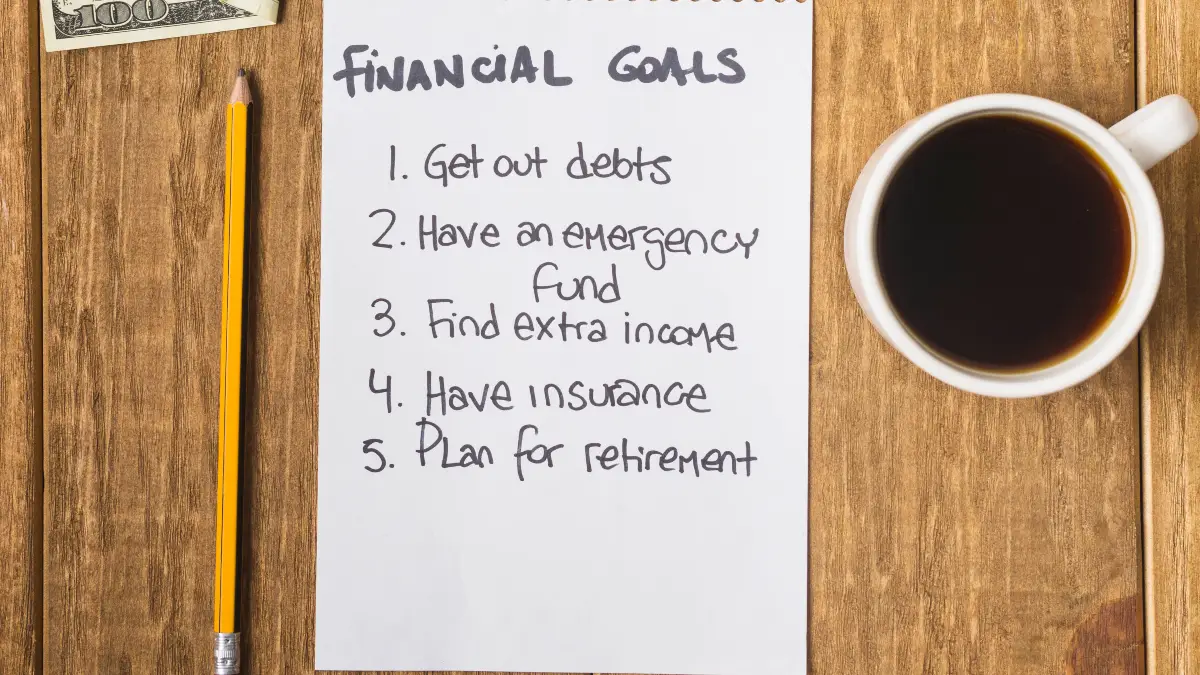

The Debt-Free Blueprint: The 5 Lessons I Wish I’d Known from Day One

Transitioning from my failed approach to a successful one required a complete overhaul of my mindset and methods.

The following five lessons are the direct antidotes to the mistakes that kept me stuck. They represent a shift from being a passive victim of debt to becoming the active architect of my own financial freedom.

1. Conduct a “Clarity Audit” – You Can’t Defeat an Enemy You Don’t See

Everything starts here. Before you can create a plan, you must have a perfect understanding of the situation. This means doing exactly what I did on that fateful night: inventorying every single dollar you owe.

Your first action should be to pull your free credit reports from all three major bureaus (Equifax, Experian, and TransUnion) via the official government-mandated site, AnnualCreditReport.com.

This is crucial for two reasons: it ensures you don’t miss any forgotten debts, and it allows you to check for errors, such as incorrect balances or accounts that don’t belong to you, which can and do happen.

Next, use the information to fill out a comprehensive worksheet. This act of writing everything down in one place is a powerful psychological tool. It moves the debt from a source of amorphous, overwhelming anxiety into a defined, manageable project.

| Table 1: The Debt Clarity Audit Worksheet | ||||

| Creditor Name | Type of Debt | Total Balance | Interest Rate (APR) | Minimum Payment |

| Example: Capital One | Credit Card | $8,250 | 22.99\% | $195 |

| Example: Best Buy | Store Card | $475 | 26.99\% | $25 |

| Example: Dept. of Ed | Student Loan | $21,500 | 5.8\% | $220 |

| Example: Honda Financial | Auto Loan | $12,300 | 4.5\% | $310 |

| Your Debt #1 | ||||

| Your Debt #2 |

2. Choose Your Weapon – The Snowball vs. Avalanche Showdown

Once you have clarity, you need a strategy. The two most effective and popular debt repayment strategies are the Debt Snowball and the Debt Avalanche.

Choosing between them is a critical decision that depends on whether you are motivated more by psychological wins or by mathematical efficiency.

- The Debt Snowball: With this method, you list your debts in order from the smallest balance to the largest, regardless of the interest rate. You make minimum payments on all your debts except for the smallest one. You attack that smallest debt with every extra dollar you can find.

- Once it’s paid off, you take its minimum payment plus all the extra money you were paying and “roll” it into the payment for the next-smallest debt.

- This creates a “snowball” of money that grows larger as it rolls down your list of debts. Its primary benefit is motivation; paying off that first small debt quickly provides a powerful psychological boost that keeps you engaged in the process.

- The Debt Avalanche: With this method, you list your debts in order from the highest interest rate (APR) to the lowest.

- You make minimum payments on all debts except for the one with the highest APR, which you attack with all your extra money. Once that debt is gone, you roll its payment into the next-highest-interest debt.

- This method is the most mathematically efficient. By tackling the most expensive debt first, you will pay less in total interest and become debt-free in the shortest amount of time.

After seeing how much my 22% APR card was costing me, I chose the Debt Avalanche. I was so horrified by the amount of money I had wasted on interest that I was purely motivated by financial optimization.

However, there is no shame in choosing the Snowball. For many people, those quick wins are the key to staying in the fight for the long haul. The best plan is the one you will actually stick with.

To see the difference, consider this example:

| Table 2: Snowball vs. Avalanche Payoff Simulation | ||

| Hypothetical Debts | Balance | APR |

| Store Card | $500 | 15% |

| Personal Loan | $3,000 | 10% |

| Credit Card | $8,000 | 22% |

| Assume $300/month available for extra payments. | ||

| Method | Total Time to Debt-Free | Total Interest Paid |

| Debt Snowball | 38 Months | $3,158 |

| Debt Avalanche | 35 Months | $2,577 |

As the table shows, the Avalanche method saves nearly $600 and gets you out of debt three months faster. The Snowball, however, delivers its first victory—paying off the store card—in just two months, which can be a powerful motivator.

You must choose your weapon based on your own financial battlefield and personal psychology.

3. Give Every Dollar a Mission – The Budget Isn’t a Straitjacket; It’s a Battle Plan

For years, I resisted budgeting. I thought it was about restriction and deprivation. I was wrong. A budget isn’t about what you can’t have; it’s about deciding what you want most.

It gives you permission to spend on what matters and the clarity to say no to what doesn’t. It is the single most effective tool for finding the “extra money” needed to fuel your debt snowball or avalanche.

The most effective method I found is zero-based budgeting. The philosophy is simple: income minus expenses equals zero. At the start of each month, you give every single dollar that you will earn a specific “job”.

Some dollars are assigned to rent, some to groceries, some to savings, and—crucially—a significant portion to your priority debt payment. There is no vague, leftover money.

Hands-on budgeting apps like YNAB (You Need A Budget) are built on this principle and can be transformative.

By forcing you to be intentional with every dollar, you quickly identify areas of wasteful spending—the subscriptions you forgot you had, the daily coffees that add up, the impulse buys.

This isn’t about cutting out all fun; it’s about making conscious choices that align with your primary goal of becoming debt-free.

4. Build Your Financial Moat – Why Saving $1,000 First Is the Most Important Step

This lesson feels completely counterintuitive, but it is the key to breaking the cycle of financial firefighting. Before you begin aggressively attacking your debt, you must build a starter emergency fund of at least $1,000.

It feels wrong to save money at a low interest rate when you have debts accruing at 20% or more. I get it. But as my car transmission story proves, without a defense, you cannot stay on offense for long.

That $1,000 is not an investment; it is a financial moat. It’s a buffer between you and life. When the water heater breaks or you need an emergency dental visit, you use the cash from your emergency fund instead of reaching for a credit card.

You then pause your extra debt payments to replenish the fund, and once it’s full, you resume your attack. This single step stops the demoralizing cycle of progress and retreat and ensures that your hard-won gains are permanent.

5. Don’t Be Afraid to Optimize – The Power of Strategic Tools

Once your plan is in motion, you can look for ways to accelerate your progress. If your credit is in decent shape, you have powerful tools at your disposal that can save you thousands of dollars in interest.

- 0% APR Balance Transfer Cards: Many credit card companies offer promotional periods—often 12 to 21 months—with 0% interest on balances you transfer from other cards. This can be a game-changer.

- By moving a high-interest balance to a 0% card, you temporarily halt the interest charges, allowing every dollar of your payment to go directly toward reducing the principal.

- Be aware of two things: there is typically a one-time transfer fee of 3% to 5% of the balance, and you absolutely must have a plan to pay off the entire balance before the promotional period ends, when the interest rate will jump to a high standard rate.

- Debt Consolidation Loans: Another option is to take out a fixed-rate personal loan to pay off multiple high-interest credit cards.

- This consolidates your debt into a single monthly payment, ideally at a much lower interest rate than your cards. This simplifies your finances and can drastically cut the total interest you pay over the life of the loan.

- Approval and the interest rate you receive will depend on your credit score and income.

- Nonprofit Credit Counseling: If you feel completely overwhelmed and your interest rates are unmanageable, do not be afraid to seek professional help

- . Reputable, nonprofit credit counseling agencies accredited by the National Foundation for Credit Counseling (NFCC) can be powerful allies. A certified counselor can review your entire financial situation, help you build a budget, and may be able to enroll you in a Debt Management Plan (DMP).

- In a DMP, the agency works with your creditors to potentially lower your interest rates, and you make one consolidated monthly payment to the agency, which then distributes the funds to your creditors.

- This is not a sign of failure; it is a smart, strategic move to regain control.

These five lessons are not just a list of tips; they are a comprehensive management framework.

The Clarity Audit is your data gathering. Choosing your weapon is your high-level strategy. Budgeting is your daily logistics and operations. The emergency fund is your risk management. And optimization is your process improvement.

Life on the Right Path: Staying Debt-Free for Good

Paying off the last of my consumer debt was one of the proudest moments of my life. But the journey doesn’t end there. The final challenge is to adopt the habits and mindset necessary to ensure you stay debt-free for good.

This involves avoiding a new set of common pitfalls and solidifying the psychological shift from a mindset of scarcity to one of empowerment.

The New Pitfalls to Avoid

Once you’ve vanquished your debt, a new set of well-intentioned but misguided instincts can emerge.

One of the most common is the desire to immediately close all the credit card accounts you just paid off. It feels like a final, symbolic victory over your old habits. However, this can actually damage your credit score.

A significant factor in your credit score is your credit utilization ratio—the amount of credit you’re using compared to the total amount of credit you have available.

When you close an account, you reduce your total available credit. If you have a balance on any other cards, your utilization ratio will instantly spike, which can cause your credit score to drop.

The smarter move is to keep your oldest credit accounts open, use them for a small, predictable purchase each month (like a streaming service), and pay the balance in full automatically. This keeps the account active and builds a positive payment history without any risk of falling back into debt.

Another major pitfall is lifestyle inflation. After years of funneling every extra dollar toward debt, you suddenly have a significant amount of free cash flow each month.

The temptation is to immediately upgrade your car, your apartment, or your spending habits. Resisting this urge is critical. The goal is to redirect the powerful “snowball” of money you were using for debt payments toward wealth-building goals, like fully funding your retirement accounts, saving for a down payment on a home, or investing for the future.

The Psychological Shift: From Deprivation to Empowerment

The most profound change that occurs after becoming debt-free is psychological. The budget, which once felt like a wartime rationing plan, evolves into a tool of empowerment.

You are no longer just managing debt; you are directing your resources toward the life you want to build.

This is where you can, and should, intentionally plan for things you enjoy. Budgeting for “fun money” or saving for a guilt-free vacation is not frivolous; it is a key part of a sustainable financial life.

The feeling is no longer one of restriction, but of control. True financial freedom isn’t just having a zero balance on your credit cards; it’s having a clear vision for your future and a solid financial plan to get you there.

You have moved from playing defense to playing offense, and that changes everything.

My Toolkit for Success

Throughout my successful journey, a few key resources were indispensable. I highly recommend them to anyone starting out:

- App: Debt Payoff Planner. While comprehensive budgeting apps are essential, this app does one thing perfectly: it shows you your debt-free date and how every extra dollar you pay can bring that date closer.

- Its charts and progress trackers are incredibly motivating on days when you feel like you’re not getting anywhere.

- Book: Dave Ramsey’s The Total Money Makeover. While I ultimately chose the Debt Avalanche method, this book’s clear, no-nonsense approach to the foundational steps—especially the starter emergency fund and the psychology of the Debt Snowball—is unparalleled for getting people fired up and focused.

- Community: The subreddit r/ynab. Surrounding yourself with people on the same path is a powerful force for accountability and encouragement.

- This community of users of the You Need A Budget app is incredibly supportive, offering practical tips and celebrating each other’s wins, no matter how small.