For millennia, gold has captivated the human imagination. It is the ultimate symbol of wealth, a timeless store of value, and the bedrock of financial security in times of turmoil.

Its allure is deeply embedded in our financial psyche, serving as the default safe-haven asset for investors seeking protection from the corrosive effects of inflation, currency debasement, and geopolitical instability.

This enduring appeal is not without merit; gold’s role as a liquid, globally recognized instrument of wealth preservation is well-established.

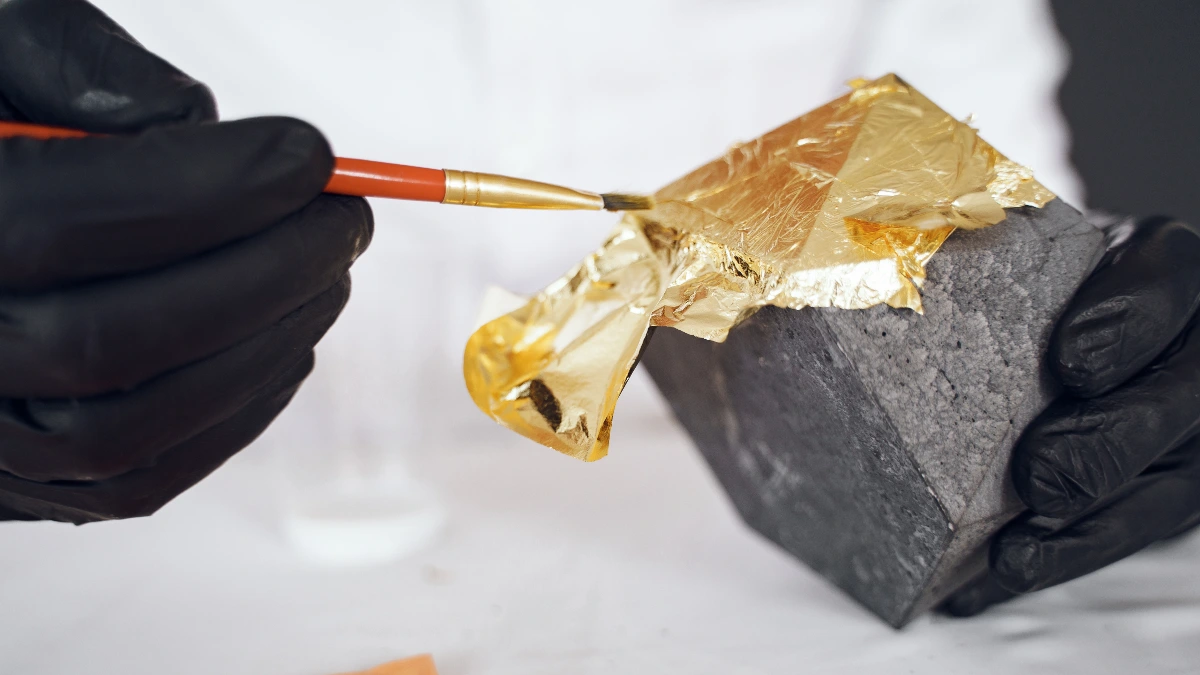

However, for the sophisticated 21st-century investor, reliance on this ancient metal presents a critical paradox.

In an era defined by innovation, productivity, and the relentless pursuit of yield, does an asset that produces no income, generates no cash flow, and whose value is predicated entirely on market sentiment and the willingness of a future buyer to pay a higher price, truly represent the ultimate physical store of value?

Gold’s inherent limitations—its price volatility, its inconsistent performance as an inflation hedge, and its complete lack of productive capacity—demand a re-evaluation of its exalted status.

This report presents a definitive, data-driven thesis: U.S. Farmland, a finite, tangible, and fundamentally productive physical asset, has historically demonstrated superior risk-adjusted returns, consistent income generation, and more reliable inflation-hedging capabilities compared to gold.

Its value is not derived from speculation or fear, but from the most essential and non-negotiable of all economic fundamentals: the global demand for food.

This analysis will first deconstruct the gilded mythology surrounding gold, establishing a clear-eyed benchmark of its actual performance and utility.

It will then present the overwhelming quantitative and qualitative case for U.S. farmland as a superior long-term holding.

Finally, it will provide a detailed, actionable guide for the modern accredited investor to access this historically inaccessible, yet profoundly valuable, asset class.

Re-evaluating the Gold Standard: A 21st Century Perspective

To appreciate the compelling case for an alternative, one must first conduct a rigorous and objective analysis of the incumbent.

Gold’s position in investment portfolios is built on a foundation of historical precedent and powerful narratives.

While some of these are valid, a closer examination reveals significant weaknesses that are often overlooked in the rush to safety during periods of market stress.

The Merits of Bullion: Why Gold Endures

It is essential to first acknowledge gold’s legitimate strengths to build a credible and balanced analysis.

The precious metal’s primary modern function is as a potent tool for portfolio diversification.

Over long periods, gold has demonstrated a near-zero correlation with the S&P 500 and a very low correlation with bonds, with a coefficient of just 0.09.

This statistical independence is invaluable; during times of acute market stress, such as a stock market crash or a geopolitical crisis, these correlations often turn negative, meaning gold’s value tends to rise as other assets fall.

This characteristic makes gold a form of “crisis insurance,” a highly liquid asset that can be sold quickly to cover losses elsewhere or to seize opportunities when other markets are in turmoil.

Central banks around the world continue to hold substantial gold reserves, reinforcing its status as a foundational monetary asset and a hedge against fluctuations in fiat currencies like the U.S. dollar.

For these reasons—liquidity, diversification, and its role as a crisis hedge—gold maintains a legitimate, albeit specific, role in a well-constructed portfolio.

The Cracks in the Gilded Facade

Despite its strengths, gold’s reputation as the ultimate safe-haven and long-term wealth builder is marred by several fundamental flaws.

These weaknesses become particularly apparent when it is evaluated not just as a short-term hedge, but as a strategic, multi-decade allocation for capital preservation and growth.

The Zero-Yield Problem

The most significant and inescapable weakness of gold is that it is a sterile, non-producing asset.

Unlike a piece of farmland that yields crops, a commercial building that generates rent, or a stock that pays dividends, gold produces no income.

It sits in a vault, incurring costs, and generates no cash flow for its owner.

This has a profound implication for long-term returns: the entirety of an investor’s profit is dependent on capital appreciation alone.

The only way to make money from gold is to sell it to someone else at a higher price than what was originally paid.

This reliance on price appreciation makes gold a purely speculative instrument in terms of growth.

It cannot compound wealth through the reinvestment of income, a primary driver of long-term returns in virtually every other major asset class.

An investment in gold is a bet on future sentiment, fear, and scarcity, not on productivity or economic value creation.

This fundamental lack of yield is a permanent drag on its potential as a wealth-compounding machine.

Volatility and Risk-Adjusted Performance

For an asset lauded as a “safe haven,” gold exhibits a remarkable degree of price volatility.

Market dynamics, global economic conditions, and geopolitical events—factors entirely beyond an investor’s control—can cause significant and rapid price fluctuations.

Historical data reveals that this volatility is not trivial; gold has experienced single-year losses as high as 32%.

Crucially, this high level of risk is not always compensated with superior returns. As subsequent analysis will show, gold’s long-term volatility has been significantly higher than that of U.S. farmland.

From 1992 to 2020, the average volatility of gold was 14.8%, more than double the 6.84% recorded for farmland.

When an asset’s risk (volatility) is disproportionately high relative to its return, it results in a poor risk-adjusted performance profile.

This suggests that investors are often taking on equity-like risk for bond-like (or lower) returns, a trade-off that is far from optimal for a portfolio’s foundational “safe” asset.

The Inconsistent Inflation Hedge

Perhaps the most pervasive myth surrounding gold is its role as the ultimate hedge against inflation.

The narrative is simple: as the purchasing power of paper currency declines, the value of tangible, finite gold should rise to compensate.

While this relationship holds true during certain periods of extreme economic distress, over the long term, the statistical evidence is surprisingly weak.

A comprehensive analysis of data since 1928 reveals that gold has a correlation coefficient of just 0.18 with inflation.

This indicates a very weak positive relationship, suggesting that gold’s price movements are not reliably driven by changes in the Consumer Price Index (CPI).

Its value is more often influenced by other factors, such as real interest rates, the strength of the U.S. dollar, and levels of market fear.

This makes its utility as a strategic, long-term inflation hedge far less certain than commonly believed. Its effectiveness is more tactical and psychological than it is structural and reliable.

The Hidden Costs of Ownership

Finally, the physical ownership of gold is not a passive, cost-free endeavor. Unlike a digital stock certificate, bullion requires secure storage, which entails ongoing fees for vaulting services.

It must also be insured against theft and loss. Furthermore, transactions in the physical gold market involve costs that erode returns, including dealer premiums over the spot price when buying, and assay fees to verify purity when selling.

While these costs may seem minor on an annual basis, they accumulate over a long holding period, acting as a constant drag on the asset’s total return and further highlighting the burden of its non-yielding nature.

The conclusion from this objective assessment is clear. Gold’s primary utility in a modern portfolio is not as a long-term, wealth-compounding, inflation-hedging asset.

Its characteristics—high liquidity, low correlation to equities, and sensitivity to market fear—position it more appropriately as a tactical instrument for short-term crisis hedging and portfolio diversification.

Its fundamental weaknesses—the absence of yield, high volatility, a weak link to inflation, and carrying costs—make it a suboptimal choice for the strategic, foundational role of a primary physical asset.

This creates a compelling opportunity to identify an alternative that retains the benefits of a tangible asset while overcoming these critical deficiencies.

The Quiet Champion: Making the Definitive Case for U.S. Farmland

While gold captures headlines and investor attention, U.S. farmland has quietly and consistently delivered superior performance for decades.

It is a tangible, finite asset that combines the inflation-hedging and diversification benefits of a real asset with the income-producing characteristics of a high-quality business.

Its investment thesis is not built on sentiment or speculation, but on the unshakeable and predictable fundamentals of human survival and global demographics.

The Data-Driven Verdict: A Head-to-Head Comparison

A direct, quantitative comparison of U.S. farmland against gold and the broader U.S. stock market (represented by the S&P 500) provides the most compelling evidence of its superiority.

The historical data, synthesized from leading institutional and governmental sources like the National Council of Real Estate Investment Fiduciaries (NCREIF) and the U.S. Department of Agriculture (USDA), paints an unambiguous picture of higher returns achieved with significantly lower risk.

Asset Class Performance Comparison (1992-2024)

| Asset Class | Average Annual Return | Volatility (Std. Dev.) | Sharpe Ratio | Correlation to S&P 500 | Correlation to Inflation (CPI) |

| U.S. Farmland | 10.15% | 6.82% | 1.09 | -0.10 | 0.69 |

| Gold | 6.25% | 14.54% | 0.24 | -0.07 | 0.18 |

| S&P 500 | 10.49% | 17.59% | 0.44 | 1.00 | N/A |

Data synthesized from NCREIF, USDA, and historical market data. Farmland returns include both capital appreciation and income. Sharpe Ratio calculated assuming a risk-free rate.

The implications of this data are profound. Over a more than 30-year period, U.S. farmland has delivered returns nearly on par with the S&P 500 but with less than 40% of the volatility.

Its Sharpe Ratio—the industry standard for measuring risk-adjusted return—is 1.09, more than double that of the S&P 500 and over four times that of gold.

This demonstrates an unparalleled efficiency in generating returns for each unit of risk taken.

Furthermore, the stability of these returns is remarkable. Farmland has generated positive combined annual returns every year for over two decades, a feat unmatched by other major asset classes.

This consistency was most evident during major economic downturns.

In the recession following the dot-com crash (Q3 2000 to Q1 2003), the S&P 500 posted a cumulative loss of 42%, while the NCREIF Farmland Index gained 14%.

Similarly, during the 2008 financial crisis, the S&P 500 lost 46%, while farmland appreciated by 17%.

This performance underscores its powerful role as a portfolio stabilizer, providing positive returns precisely when traditional assets are faltering.

The Unbreakable Fundamentals: Inelastic Demand Meets Shrinking Supply

The exceptional historical performance of farmland is not a statistical anomaly; it is the direct result of one of the most powerful and enduring economic forces: a structural imbalance between supply and demand.

The Demand Engine

The demand for the products of farmland—food, fiber, and fuel—is fundamentally inelastic and relentlessly growing.

This growth is driven by two primary, long-term demographic trends that are virtually guaranteed to continue for decades.

First, global population growth. The United Nations projects that the world population will expand from 8 billion today to over 9.7 billion by 2050.

To feed this larger population, global agricultural output will need to nearly double from 2010 levels.

This creates a baseline of ever-increasing, non-negotiable demand for the productive capacity of the world’s agricultural land.

Second, rising global prosperity. As nations across the developing world emerge into the middle class, their dietary habits evolve.

A key feature of this shift is increased consumption of protein-rich foods like meat and dairy. Producing a single pound of beef requires approximately ten pounds of feed grain.

This “dietary multiplier effect” means that as global wealth increases, the per-capita demand for grains and other crops grows even faster than the population, placing immense and accelerating pressure on the finite supply of productive land.

The Supply Constraint

While demand is on a permanent upward trajectory, the supply of high-quality U.S. farmland is, for all practical purposes, fixed and actively shrinking.

This reality is best captured by the timeless wisdom of Mark Twain: “Buy land, they’re not making it anymore”.

The supply of arable land is finite. Worse, it is being consistently eroded by urbanization and infrastructure development.

According to USDA estimates, the United States has been losing productive agricultural land at an alarming rate, with some analyses suggesting a loss of approximately 6 acres every minute.

This continuous reduction in the supply of the fundamental means of production, set against a backdrop of constantly rising demand, creates a powerful and sustained tailwind for the long-term appreciation of farmland values.

This is a classic economic scenario that provides a durable foundation for the asset’s price performance, independent of the cycles of financial markets.

The Superior Inflation Hedge: A Causal Relationship

Farmland’s effectiveness as an inflation hedge is not merely a correlation; it is a direct, causal relationship.

Unlike gold, whose link to inflation is often tenuous and psychological, farmland’s value is structurally tied to the very components that drive inflation.

The Consumer Price Index (CPI), the primary measure of inflation, is heavily influenced by the cost of food. When food prices rise, it is a direct driver of headline inflation.

For a farmland owner, this process translates directly into higher returns. Rising commodity prices mean the crops grown on the land are more valuable.

This increases the revenue and profitability of the tenant farmer, who can then afford to pay higher annual cash rents to the landowner.

This increased income stream, combined with the higher underlying value of the commodities the land produces, leads to a direct increase in the appraised value of the farmland itself.

The data confirms this powerful, intuitive link. As shown in Table 1, the correlation coefficient between U.S. farmland values and inflation is 0.69, indicating a strong positive relationship.

This is nearly four times stronger than gold’s correlation of 0.18, making farmland a far more reliable and effective vehicle for preserving purchasing power over the long term.

The Dual-Return Engine: “Gold with a Yield”

Perhaps the single most compelling advantage of farmland over gold is its ability to generate returns from two distinct and complementary sources. This has led to it being aptly described as “gold with a yield”.

Component 1: Annual Income (The “Yield”)

The first return stream is the stable, recurring income generated from leasing the land to farmers. Investors receive regular payments, typically annually, in the form of cash rent.

This provides a consistent, bond-like cash flow that is secured by the fundamental necessity of food production.

Historically, unlevered cash yields on lower-risk properties have ranged from 3% to 5% annually.

This income component provides a crucial buffer to total returns, ensuring a positive yield even in years when land values may be flat or experience a minor decline. It is this income stream that gold fundamentally lacks.

Component 2: Capital Appreciation (The “Gold”)

The second return stream is the long-term appreciation in the value of the land itself.

This growth component is driven by the powerful and enduring supply and demand fundamentals previously discussed—a growing global population demanding more food from a shrinking base of arable land.

This provides the potential for significant capital gains over the holding period, akin to the appreciation investors seek from gold, but supported by tangible economic productivity rather than speculation.

The combination of these two return streams—stable income and long-term growth—is what underpins farmland’s superior risk-adjusted performance.

The income provides stability and a floor on returns, while the appreciation provides the engine for wealth creation.

This dual-engine structure makes it a uniquely resilient and powerful asset class, offering both defensive and growth characteristics within a single, tangible investment.

The Modern Investor’s Actionable Guide to Owning “The Good Earth”

For most of its history, direct investment in U.S. farmland was the exclusive domain of institutional investors, ultra-high-net-worth families, and professional farm operators.

The barriers to entry—including immense capital requirements, the need for specialized agricultural expertise, and the complexities of active management—were simply too high for the vast majority of individual investors.

However, a revolution in financial technology and investment structures has democratized access, creating new and highly efficient pathways for accredited investors to add this premier asset class to their portfolios.

The Accessibility Revolution

The advent of publicly traded Real Estate Investment Trusts (REITs) and, more recently, specialized online crowdfunding platforms has fundamentally changed the landscape of farmland investing.

These vehicles have effectively dismantled the traditional barriers, allowing investors to gain exposure to diversified portfolios of high-quality farmland with lower minimum investments and without the burden of direct operational management.

Understanding the distinct characteristics of these modern methods is the key to making an informed investment decision.

Method 1: The Public Market Approach (Farmland REITs)

A Real Estate Investment Trust (REIT) is a company that owns, operates, or finances a portfolio of income-producing properties and is traded on a public stock exchange.

A farmland REIT allows an investor to buy shares in a large, professionally managed, and geographically diversified portfolio of farms, offering a simple and highly liquid method of gaining exposure to the asset class.

Case Study: Farmland Partners (NYSE: FPI)

- Business Model: Farmland Partners Inc. is an internally managed REIT that follows a straightforward model: it acquires high-quality U.S. farmland and then leases it to experienced farm operators. Its returns are derived from this rental income and the long-term appreciation of its land holdings. The company also generates ancillary revenue through asset management services for third parties and brokerage and auction services via its subsidiary.

- Portfolio: FPI owns and/or manages a substantial portfolio of over 125,000 acres spread across more than 15 states. This diversification includes a mix of primary row crops (like corn and soybeans) and higher-value specialty crops, which helps mitigate risks associated with specific commodities or regional weather events.

- Performance & Dividends: As a publicly traded stock, FPI’s share price offers daily liquidity but is also subject to the volatility and sentiment of the broader equity market. Its performance does not always perfectly track the underlying value of its farmland assets. The company has a history of paying dividends to shareholders, derived from the rental income it collects.

Case Study: Gladstone Land (NASDAQ: LAND)

- Business Model: Gladstone Land Corporation is an externally managed REIT with a more specialized focus. It concentrates on acquiring high-value farms that produce fresh annual row crops (such as berries and vegetables) and permanent crops (like almonds, pistachios, and wine grapes). These properties are typically leased on a “triple-net” basis, where the tenant is responsible for taxes, insurance, and maintenance, providing a more predictable income stream for the REIT.

- Performance: Similar to FPI, LAND provides investors with liquid exposure to farmland, but its stock price is also influenced by overall market trends, interest rate changes, and investor sentiment, which can cause its performance to diverge from the private market value of farmland.

Pros & Cons Analysis

- Pros:

- High Liquidity: Shares can be bought and sold on major stock exchanges throughout the trading day, offering easy entry and exit.

- Low Investment Minimum: The minimum investment is simply the cost of a single share, making it accessible to a wide range of investors.

- Professional Management: The portfolio is managed by a team of experienced professionals, relieving the investor of any operational responsibilities.

- Cons:

- Imperfect Correlation: The primary drawback is that a REIT’s stock price is correlated with the broader stock market. This dilutes the diversification benefit that makes farmland so attractive. The value can be driven by market-wide panic or sector-specific fears (e.g., rising interest rates affecting all REITs) rather than the fundamental value of the underlying land.

- Management Risk: Performance is dependent on the strategic decisions and execution of the REIT’s management team.

Method 2: The Fractional Ownership Revolution (Crowdfunding)

A more recent and innovative approach, crowdfunding platforms provide a mechanism for direct, fractional ownership of individual farm properties.

These platforms identify and perform due diligence on specific farms, place each property into a unique Limited Liability Company (LLC), and then allow accredited investors to purchase shares in that LLC.

This model offers a purer, more direct form of exposure to the asset class.

Platform Deep Dive: AcreTrader

- Process: AcreTrader employs a rigorous five-step process. It begins with a stringent farm selection and due diligence phase, accepting only a small fraction of properties for its platform. Each selected farm is placed into an LLC. Investors can then browse offerings online, review all due diligence materials (including soil maps, water rights documentation, and financial projections), and invest electronically. AcreTrader’s management team handles all administration and property management, making it a completely passive investment. Annual cash distributions from rental income are paid to investors, and at the end of the target hold period (typically 5-10 years), the property is sold, with proceeds returned to the investors.

- Investor Profile: Investment is restricted to accredited investors, who must meet specific income ($200,000+ annually) or net worth ($1 million+) thresholds as defined by the SEC. The minimum investment for most deals typically ranges from $10,000 to $15,000.

- Fees & Returns: AcreTrader is known for its simple and transparent fee structure: a flat 0.75% annual administration fee based on the farm’s value, deducted from income before distributions. The platform targets an unlevered Internal Rate of Return (IRR) of 7% to 9%, which includes both annual cash yields (projected at 3-5%) and long-term land appreciation.

Platform Deep Dive: FarmTogether

- Process & Offerings: FarmTogether operates on a similar LLC-based model for individual deals but also offers a broader range of products. In addition to crowdfunded offerings, it provides diversified farmland funds for investors seeking exposure to multiple properties through a single investment, as well as bespoke sole-ownership opportunities for high-net-worth clients with multi-million dollar allocations.

- Investor Profile: Like AcreTrader, FarmTogether is open only to accredited investors. The minimum investment for its crowdfunded deals starts at $15,000. The minimums are higher for its fund products, often starting at $50,000 or more.

- Fees & Returns: The fee structure on FarmTogether can be more variable than AcreTrader’s. It often includes an annual management fee ranging from 1% to 2%, and may also include upfront fees for structuring the deal. To compensate for the higher fees, the platform often targets slightly higher returns, with projected IRRs in the 8% to 10% range for some offerings.

Farmland Crowdfunding Platform Comparison

| Feature | AcreTrader | FarmTogether |

| Investor Requirements | Accredited Only | Accredited Only |

| Minimum Investment | Typically $10,000 – $15,000 | Crowdfunded: $15,000+; Funds: $50,000+ |

| Annual Management Fee | Flat 0.75% of farm value | Variable, typically 1.0% – 2.0% |

| Other Fees | Potential closing costs | Upfront project/structuring fees may apply |

| Target Hold Period | 5 – 10 years | 5 – 12 years |

| Liquidity Options | No formal secondary market; potential for private sale after 1 year | Developing a secondary market; generally illiquid |

| Product Offerings | Individual farm deals | Individual deals, diversified funds, bespoke sole ownership |

Data synthesized from platform disclosures and independent reviews.

Pros & Cons Analysis

- Pros:

- Direct Asset Exposure: This is the key advantage. By investing in an LLC that holds a single property, the investor’s returns are tied directly to the performance of that specific farm, providing a “purer” form of diversification that is insulated from stock market sentiment.

- Passive Income: Platforms handle all management, allowing investors to collect income without any operational burden.

- Access to Vetted Deals: Investors gain access to high-quality agricultural properties that have undergone a rigorous institutional-level due diligence process.

- Cons:

- High Illiquidity: This is the most significant drawback. Capital is typically locked up for a multi-year holding period (5 to 10 years or more), with limited to no options for early exit.

- Accredited Investors Only: These platforms are generally not accessible to the broader retail investing public.

- Platform Risk: Investors are reliant on the expertise and financial stability of the crowdfunding platform itself. The quality of the platform’s underwriting is paramount.

The choice between a REIT and a crowdfunding platform represents a fundamental trade-off.

There is no single “best” method; the optimal vehicle depends entirely on the investor’s individual objectives.

A REIT offers daily liquidity, making it suitable for investors who prioritize the ability to access their capital quickly.

However, this liquidity comes at the cost of higher correlation to the volatile stock market, which can undermine the primary goal of diversification.

Conversely, a crowdfunding platform offers a much more authentic and direct investment in the underlying asset, delivering the powerful, uncorrelated returns that make farmland unique.

The price for this “purer” diversification is significant illiquidity. Therefore, an investor seeking to truly stabilize a portfolio of stocks and bonds should lean toward crowdfunding, accepting the long-term commitment.

An investor who values flexibility above all else may prefer a REIT, accepting the associated market risk.

Method 3: The Direct Path (Outright Purchase)

For the sake of completeness, it is important to acknowledge the traditional method of direct ownership.

This involves purchasing an entire farm outright. While this path offers complete control, it remains largely impractical for most investors.

The barriers to entry are immense, including prohibitive capital requirements (the average U.S. farm costs over $2.4 million), the need for deep, specialized knowledge in fields like agronomy, soil science, and water law, and the significant time and effort required for active operational management.

This approach is best suited for large institutions and professional farm operators rather than individual portfolio investors.

Due Diligence and Risk Mitigation

No investment is without risk, and a professional, clear-eyed assessment of potential downsides is essential for prudent capital allocation.

While U.S. farmland boasts a uniquely stable and attractive risk profile, investors must be aware of the factors that can impact returns.

A thorough due diligence process is critical to mitigating these risks and selecting high-quality assets.

Acknowledging the Inherent Risks

The risks associated with farmland investing can be categorized into three main areas: systemic, operational, and structural.

- Systemic & Market Risks:

- Commodity Price Volatility: While long-term demand for food is stable, the short-term prices of specific commodities (e.g., corn, soybeans, almonds) can be volatile. A significant downturn in the price of a farm’s primary crop can reduce the tenant’s profitability and, in turn, put pressure on cash rental rates.

- Interest Rate Risk: Like all real estate, farmland values can be sensitive to changes in interest rates. A sharp rise in rates can increase the cost of financing for farm purchases and may offer investors more attractive yields in lower-risk assets like bonds, potentially putting downward pressure on farmland valuations.

- Operational & Environmental Risks:

- Weather and Climate: Agriculture is fundamentally dependent on the weather. Extreme events such as prolonged droughts, floods, or unseasonal frosts can severely impact crop yields and farm revenue.

- Tenant Risk: The financial health and operational expertise of the tenant farmer are crucial. A tenant who mismanages the property or faces financial distress may default on their lease payments, interrupting the investor’s income stream.

- Pests and Disease: Outbreaks of crop-specific diseases or pests can also negatively affect yields and profitability.

- Liquidity & Platform Risks:

- Illiquidity: For investors using crowdfunding platforms, this is the most significant structural risk. Capital is committed for long, multi-year holding periods with no guaranteed mechanism for an early exit. Investors must be prepared to hold the asset to term.

- Platform Risk: When investing through a platform, the investor is placing trust in that platform’s due diligence process, management capabilities, and long-term financial stability. A failure in any of these areas could jeopardize the investment.

The Prudent Investor’s Due Diligence Checklist

A disciplined due diligence process can significantly mitigate these risks.

Before committing capital, investors should scrutinize several key areas of any potential investment, whether it be a REIT or a specific crowdfunding deal.

For REITs:

- Management Team: Investigate the background and track record of the REIT’s leadership. Do they have deep experience in both agriculture and real estate capital markets?

- Portfolio Analysis: Examine the composition of the portfolio. How well is it diversified across different geographic regions and crop types? Over-concentration in a single crop or state increases risk.

- Balance Sheet Health: Analyze the company’s financial statements, paying close attention to its debt levels (debt-to-equity ratio) and its ability to service that debt.

For Crowdfunding Platforms & Deals:

- Water Rights: This is arguably the single most critical factor in modern farmland investing. The legal security and physical availability of water are paramount. An investor must understand the property’s water source (e.g., groundwater aquifer, surface river) and the legal standing of its rights, especially in water-scarce regions of the American West. The legal frameworks vary significantly, from riparian rights (based on adjacency to a water source) in the East to the “first in time, first in right” system of prior appropriation in the West. A farm with senior, well-documented water rights is fundamentally more valuable and less risky than one with junior or uncertain rights. In an era of increasing climate stress, water is the ultimate determinant of long-term value. A property’s worth is not merely in its soil, but in its legally defensible access to water.

- Soil Quality: The due diligence materials provided by the platform should include detailed soil composition studies and maps. High-quality, fertile soil is the foundation of agricultural productivity and directly impacts crop yields and long-term sustainability.

- Tenant Quality: Scrutinize the operating history, farming expertise, and financial stability of the tenant farmer who will be leasing the land. A strong, experienced tenant with a solid balance sheet is a key risk mitigant.

- Capitalization Rate (Cap Rate): The cap rate is a crucial metric for evaluating the initial return on a real estate investment. It is calculated as the farm’s annual Net Operating Income (NOI) divided by its purchase price. This figure represents the unlevered annual cash yield. Comparing the cap rates of different deals allows an investor to assess their relative value.

- Exit Strategy: Review the platform’s stated plan for selling the property at the end of the holding period. Is the strategy based on reasonable assumptions about future market conditions? Is there a clear process for marketing and liquidating the asset?

By systematically working through this checklist, investors can move beyond the headline return projections and make a more informed, risk-aware decision, significantly increasing the probability of a successful long-term investment.

Conclusion: Planting the Seeds of Future Wealth

The long-held convention of gold as the ultimate physical asset deserves scrutiny in the modern investment landscape.

A rigorous, data-driven analysis reveals an asset class that, while useful for tactical hedging, is fundamentally flawed as a long-term engine for wealth creation due to its lack of yield, high volatility, and unreliable performance as an inflation hedge.

In its place, this report has presented the definitive case for U.S. Farmland. The evidence is overwhelming and multifaceted.

On a quantitative basis, farmland has historically delivered equity-like returns with bond-like volatility, resulting in a risk-adjusted performance profile that is vastly superior to both gold and the S&P 500.

On a qualitative basis, its value is underpinned by the most powerful and predictable long-term fundamentals imaginable: the non-negotiable need to feed a growing global population from a finite and shrinking supply of arable land.

Farmland should therefore be viewed not merely as an “alternative” to gold, but as a fundamental “upgrade.”

It takes the tangible security and inflation-hedging characteristics of a physical asset and combines them with the productive, cash-flowing capacity of a well-run business. It is, in essence, “gold with a yield”—an asset that offers both capital appreciation and a steady stream of income.

As the investor Michael Burry, famed for his foresight in “The Big Short,” has stated, “I believe that agricultural land – productive agricultural land with water on site – will be valuable in the future”.

The revolution in investment platforms has now made this premier asset class accessible to accredited investors.

Through publicly traded REITs and, more directly, via specialized crowdfunding vehicles, a strategic allocation to U.S. farmland is no longer a theoretical ideal but an actionable strategy.

For the sophisticated investor looking to build a more resilient, more productive, and truly diversified portfolio for the decades to come, the time has come to look beyond the sterile allure of the vault and plant the seeds of future wealth in the good, productive earth.