You make minimum payments religiously. You budget carefully. Yet your debt keeps growing, leaving you frustrated and confused about why you can’t break free.

Here’s the truth: paying off debt isn’t just about math. Your own mind works against you through hidden psychological traps that sabotage even your best financial intentions.

These mental barriers keep millions trapped in cycles of borrowing and barely-there payments, costing thousands in unnecessary interest.

But once you understand how these four specific mental traps operate, you can outsmart them. Ready to discover what’s really keeping you in debt and learn the science-backed strategies to escape?

4 Mental Traps in Minute Detail

Understanding these psychological barriers is crucial for breaking free from debt cycles. Each trap operates below conscious awareness, sabotaging even the best financial intentions.

1. The Ostrich Effect (Avoidance & Denial)

This psychological defense mechanism involves deliberately ignoring financial reality. People avoid opening bills, refuse to check account balances, or tell themselves the situation isn’t serious.

The brain seeks temporary relief from overwhelming anxiety by pretending problems don’t exist.

Avoidance creates a destructive cycle where debt grows silently while anxiety intensifies.

Interest compounds daily, late fees accumulate, and manageable problems become genuinely overwhelming. Credit scores deteriorate as the avoided reality becomes increasingly harsh.

What started as emotional protection becomes financial devastation. Each day of denial costs real money through compounding interest and penalties.

The longer someone avoids confronting their debt, the more terrifying and unmanageable it becomes, validating their original fears and making future action even more difficult.

• Who mostly falls for it: People with high anxiety, shame-prone personalities, or those who learned to avoid difficult emotions during childhood.

2. The Snowball Fallacy (Focusing Solely on Smallest Debts)

Many people prioritize paying off the smallest debts first, seeking quick psychological wins. This approach feels good because it provides immediate satisfaction and a sense of accomplishment.

However, focusing exclusively on small balances while ignoring interest rates creates significant financial harm.

Mathematical inefficiency emerges when high-interest debts continue growing while you celebrate small victories.

You might eliminate a $500 loan at 5% interest while a $10,000 credit card at 25% keeps compounding. The emotional boost from small wins doesn’t compensate for thousands in additional interest charges.

This trap exploits our need for instant gratification over long-term thinking. While motivation matters in debt repayment, purely emotion-driven decisions often lead to paying significantly more money over time.

The key lies in balancing psychological momentum with mathematical efficiency to achieve both motivation and optimal financial outcomes.

• Who mostly falls for it: People who need instant gratification, seek frequent encouragement, or prioritize emotional satisfaction over mathematical optimization.

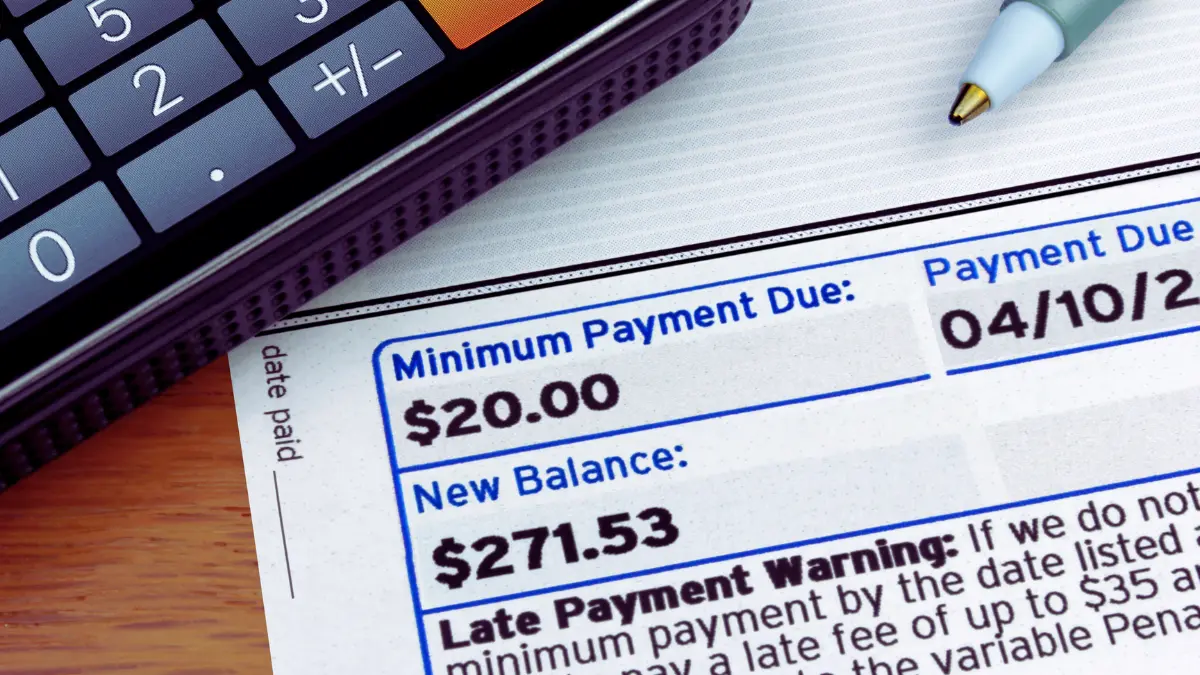

3. The Minimum Payment Illusion

Credit card statements prominently display minimum payments, creating a powerful anchoring effect in your mind. This low number becomes the reference point for what seems reasonable to pay.

Many people believe making minimum payments constitutes responsible debt management and adequate progress toward freedom.

Research by Dr. Neil Stewart at the University of Warwick demonstrates how minimum payment prompts significantly reduce actual payment amounts.

His study published in Psychological Science found that showing minimum options caused people to pay less than they would have otherwise. This anchoring effect often doubles total interest paid and extends debt duration by years.

Minimum payments are mathematically designed to maximize lender profit while keeping borrowers trapped. These payments primarily cover interest charges with minimal principal reduction.

A $5,000 credit card balance at 18% APR takes over 30 years to eliminate with minimum payments, costing more than $7,000 in additional interest charges.

• Who mostly falls for it: Partial payers who can afford larger payments but lack awareness of true costs, often influenced by statement design and psychological anchoring.

4. Decision Paralysis & Overwhelm

Complex debt situations can trigger cognitive overload, causing complete inaction.

Multiple creditors with different interest rates, varying payment schedules, and seemingly insurmountable balances create mental shutdown. The brain freezes when faced with too many variables and high-stakes decisions.

This paralysis often accompanies catastrophic thinking and analysis paralysis. People tell themselves they need to research every possible option before taking action.

Meanwhile, they take no action whatsoever, allowing interest to compound while searching for the elusive solution.

Inaction guarantees debt persistence and growth through daily interest accumulation. A $10,000 debt at 20% interest costs approximately $5.50 daily in interest charges.

Each day of delay represents real money lost to indecision. The feeling of helplessness becomes self-fulfilling, preventing exploration of viable solutions like consolidation or systematic payoff strategies.

• Who mostly falls for it: Perfectionists, people with complex debt situations, or those prone to analysis paralysis and indecisiveness in other life areas.

5 Ways to Escape Debt Mental Traps

Breaking free from these psychological barriers requires specific strategies that address both emotional and practical aspects of debt management. These evidence-based approaches help transform overwhelming debt into manageable action steps.

1. Face the Numbers Directly

Schedule a dedicated session to gather every piece of debt information. Create a comprehensive list including each creditor, current balance, interest rate, minimum payment, and due date.

Calculate your total debt burden and monthly obligations to see the complete financial picture.

This process transforms abstract anxiety into concrete, actionable data. While initially frightening, seeing the full scope removes uncertainty and provides a definitive starting point.

Knowledge replaces fear, enabling strategic decision-making instead of emotional avoidance.

Many people discover their situation is more manageable than their anxiety-driven imagination suggested. The act of organization itself often reveals patterns and opportunities previously hidden by avoidance.

Writing down how each debt makes you feel helps process the psychological weight alongside the financial reality.

• Suited for: People with avoidance tendencies, high debt anxiety, or those paralyzed by uncertainty who need structure to break through denial.

2. Choose Payoff Strategy Wisely

Select a systematic debt elimination method based on both mathematical efficiency and your psychological makeup.

The debt avalanche prioritizes highest interest rates first, saving maximum money over time. The debt snowball targets smallest balances first, providing quick psychological wins to maintain motivation.

Research by Harvard Business School economists demonstrates the effectiveness of strategic approaches.

Their study found that people using the debt snowball method were more likely to eliminate all debts completely, despite paying more in total interest.

The psychological momentum from early victories outweighed mathematical inefficiency for many participants.

Consider a hybrid approach combining both methods. Eliminate one or two small debts quickly for immediate motivation, then switch to targeting highest interest rates.

This strategy provides psychological momentum while minimizing long-term costs, balancing emotional needs with financial optimization.

• Suited for: Analytically-minded people who prioritize efficiency (avalanche) or motivation-driven individuals who need quick wins (snowball).

3. Break the Minimum Payment Spell

Use online debt calculators to visualize the true cost of minimum payments. Input each debt’s balance, interest rate, and minimum payment to see total payoff time and interest charges. These results often provide the emotional shock needed to motivate larger payments.

Establish personal minimum payments that exceed lender suggestions based on your chosen strategy. Treat these enhanced amounts as your true minimums, not the profit-maximizing numbers on statements.

This reframes your relationship with debt from meeting lender requirements to actively attacking principal balances.

Automate these enhanced payments immediately after paydays to ensure consistency. Remove the daily willpower requirement by making debt reduction automatic.

Each payment above the suggested minimum represents real progress toward freedom rather than treading water in an endless cycle of interest charges.

• Suited for: Habitual partial payers, people easily influenced by default options, or those who need dramatic visual evidence to motivate change.

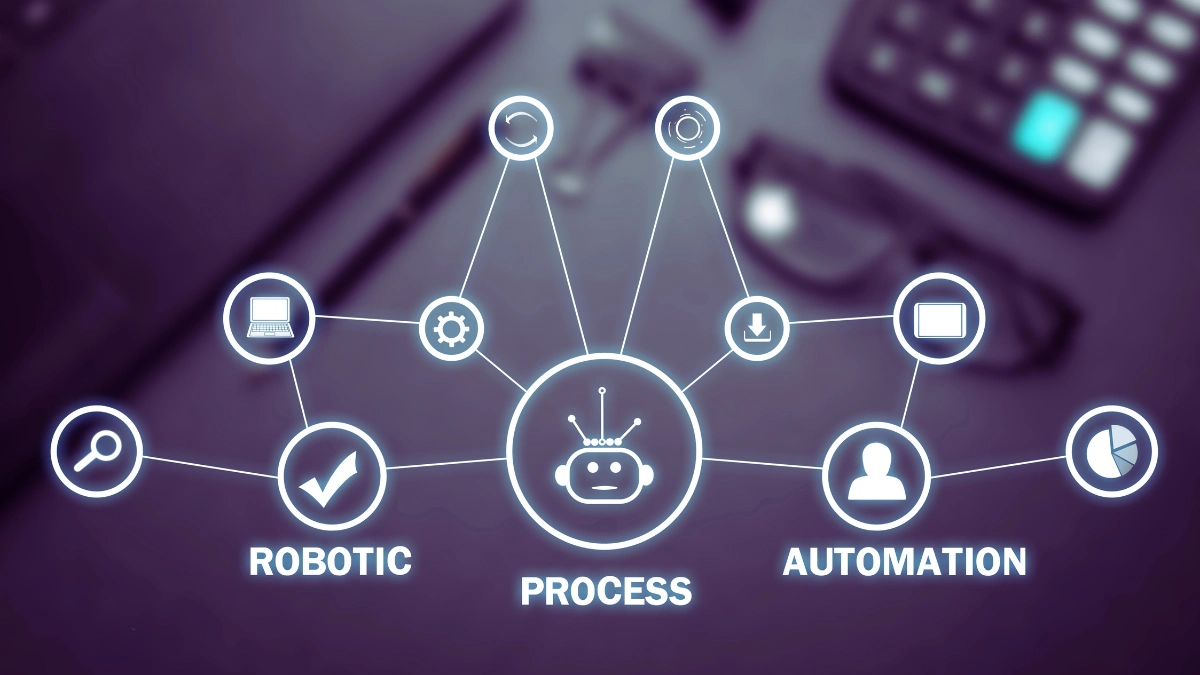

4. Automate and Simplify

Set up automatic minimum payments for all debts to prevent late fees and credit damage. More importantly, automate strategic extra payments the day after each paycheck arrives.

This approach treats debt elimination like any other essential expense rather than an optional consideration.

Automation removes the need for constant decision-making and willpower, which research shows depletes throughout the day.

Consistent progress occurs regardless of mood, motivation, or daily stresses. The mental load of debt management decreases significantly when systems handle the heavy lifting.

Evaluate consolidation options carefully for complex situations. Balance transfers to lower interest cards or personal loans can simplify tracking and reduce costs.

However, these strategies require commitment to avoiding new debt accumulation while paying off consolidated balances more aggressively than previous minimum payments.

• Suited for: Busy professionals, people prone to procrastination, or anyone seeking to reduce the mental energy required for debt management.

5. Reframe and Reward

Transform how you think about debt payments by viewing them as investments in future freedom rather than money lost.

Each payment purchases peace of mind, reduced stress, and increased financial options. This psychological shift changes debt elimination from punishment into empowerment.

Create visual progress tracking using charts, apps, or simple graphics you’ll see daily. Watching balances decrease provides powerful motivation and tangible evidence of success.

The brain responds strongly to visual progress, making abstract financial improvements feel real and achievable.

Establish specific milestones to celebrate with modest, budget-friendly rewards. Acknowledge paying off individual creditors or maintaining your plan for specific timeframes.

Choose celebrations that don’t involve spending money, like favorite home-cooked meals, relaxing activities, or time with supportive friends who understand your goals.

• Suited for: People motivated by visual progress, those needing positive reinforcement, or individuals struggling with debt-related shame who benefit from celebration.